By GlobeNewswire, July 27, 2017

Kalamazoo, Michigan – July 27, 2017 – Stryker Corporation (NYSE:SYK) reported operating results for the second quarter of 2017:

Second Quarter Highlights

Net sales grew 6.1% to $3.0 billion (6.9% constant currency)

| Orthopaedics | 5.5 | % | or | 6.5% constant currency |

| MedSurg | 6.2 | % | or | 6.8% constant currency |

| Neurotechnology and Spine | 6.9 | % | or | 7.9% constant currency |

Adjusted net earnings per diluted share(1) increased 10.1% to $1.53

Reported net earnings per diluted share increased 3.0% to $1.03

“Our growth momentum continued in the second quarter as we continue to drive share gains through new products and strong commercial execution,” said Kevin A. Lobo, Chairman and Chief Executive Officer. “We are raising our full year guidance for both organic sales growth and EPS, which reflects our expectations for continued strong performance throughout the year.”

Sales Analysis

Consolidated net sales of $3.0 billion increased 6.1% in the quarter as reported and 6.9% in constant currency, as foreign currency exchange rates negatively impacted net sales by 0.8%. Excluding the 0.2% impact of acquisitions, net sales in the quarter increased 6.7% in constant currency, including 8.2% from increased unit volume partially offset by 1.5% due to lower prices.

Orthopaedics net sales of $1.1 billion increased 5.5% in the quarter as reported and 6.5% in constant currency, as foreign currency exchange rates negatively impacted net sales by 1.0%. Excluding the 0.3% impact of acquisitions, net sales in the quarter increased 6.2% in constant currency, including 8.6% from increased unit volume partially offset by 2.4% due to lower prices.

MedSurg net sales of $1.3 billion increased 6.2% in the quarter as reported and 6.8% in constant currency, as foreign currency exchange rates negatively impacted net sales by 0.6%. Excluding the 0.1% impact of acquisitions, net sales in the quarter increased 6.7% in constant currency, including 7.1% from increased unit volume partially offset by 0.4% due to lower prices.

Neurotechnology and Spine net sales of $0.5 billion increased 6.9% in the quarter as reported and 7.9% in constant currency, as foreign currency exchange rates negatively impacted net sales by 1.0%. Net sales in the quarter increased 10.0% from increased unit volume partially offset by 2.1% due to lower prices.

Earnings Analysis

Reported net earnings of $391 million increased 2.9% in the quarter. Reported net earnings per diluted share of $1.03 increased 3.0% in the quarter. Reported net earnings include certain charges for the amortization of purchased intangible assets, Rejuvenate and ABG II and other recall matters, restructuring-related activities, legal matters and acquisition and integration related activities. The effect of each of these matters on reported net earnings and net earnings per diluted share appears in the reconciliation of actual results to adjusted results below. Excluding the impact of these charges increases gross profit margin in the quarter from 66.1% to 66.3% and increases operating income margin from 16.6% to 25.0%. Excluding the impact of the items described above, adjusted net earnings(2) of $581 million increased 10.7% in the quarter. Adjusted net earnings per diluted share(1) of $1.53 increased 10.1% in the quarter.

2017 Outlook

We now expect 2017 organic net sales growth to be in the range of 6.5% to 7.0% and adjusted net earnings per diluted share(3) to be in the range of $6.45 to $6.55. For the third quarter we expect adjusted net earnings per diluted share(3) to be in the range of $1.50 to $1.55. If foreign currency exchange rates hold near current levels, we expect net sales in the third quarter and full year to be negatively impacted by approximately 0.5% and adjusted net earnings per diluted share to be negatively impacted by approximately $0.02 in the third quarter and $0.10 in the full year.

(1) A reconciliation of reported net earnings per diluted share to adjusted net earnings per diluted share, a non-GAAP financial measure, and other important information appears below.

(2) A reconciliation of reported net earnings to adjusted net earnings, a non-GAAP financial measure, and other important information appears below.

(3) A reconciliation of expected net earnings per diluted share to expected adjusted net earnings per diluted share for the third quarter and full year and other important information appears below.

Conference Call on Thursday, July 27, 2017

As previously announced, the Company will host a conference call on Thursday, July 27, 2017 at 4:30 p.m., Eastern Time, to discuss the Company’s operating results for the quarter ended June 30, 2017 and provide an operational update.

To participate in the conference call dial (844) 826-0610 (domestic) or (973) 453-3249 (international) and be prepared to provide conference ID number 26061645 to the operator.

A simultaneous webcast of the call will be accessible via the Company’s website at www.stryker.com. The call will be archived on the Investors page of this site.

A recording of the call will also be available from 8:00 p.m., Eastern Time, on Thursday, July 27, 2017, until 11:59 p.m., Eastern Time, on Thursday, August 3, 2017. To hear this recording, you may dial (855) 859-2056 (domestic) or (404) 537-3406 (international) and enter conference ID number 26061645.

Caution Concerning Forward-Looking Statements

This press release contains information that includes or is based on forward-looking statements within the meaning of the federal securities laws that are subject to various risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in such statements. Such factors include, but are not limited to: weakening of economic conditions that could adversely affect the level of demand for our products; pricing pressures generally, including cost-containment measures that could adversely affect the price of or demand for our products; changes in foreign exchange markets; legislative and regulatory actions; unanticipated issues arising in connection with clinical studies and otherwise that affect U.S. Food and Drug Administration approval of new products; potential supply disruptions; changes in reimbursement levels from third-party payors; a significant increase in product liability claims; the ultimate total cost with respect to the Rejuvenate and ABG II matter; the impact of investigative and legal proceedings and compliance risks; resolution of tax audits; the impact of the federal legislation to reform the United States healthcare system; changes in financial markets; changes in the competitive environment; our ability to integrate acquisitions; and our ability to realize anticipated cost savings. Additional information concerning these and other factors is contained in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

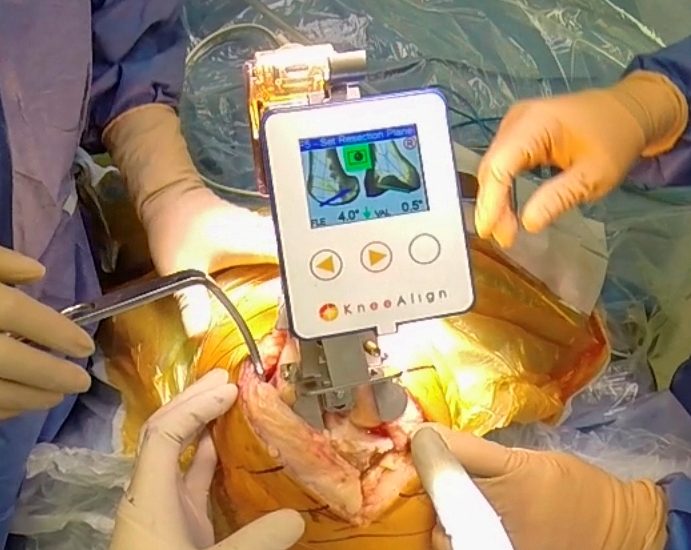

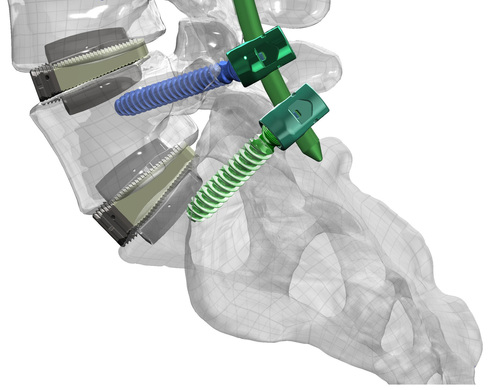

Stryker is one of the world’s leading medical technology companies and, together with our customers, we are driven to make healthcare better. The Company offers a diverse array of innovative products and services in Orthopaedics, Medical and Surgical, and Neurotechnology and Spine that help improve patient and hospital outcomes. Stryker is active in over 100 countries around the world. Please contact us for more information at www.stryker.com.

For investor inquiries please contact:

Katherine A. Owen, Stryker Corporation, 269-385-2600 or katherine.owen@stryker.com

For media inquiries please contact:

Yin Becker, Stryker Corporation, 269-385-2600 or yin.becker@stryker.com

| STRYKER CORPORATION

For the Three and Six Months June 30 (Unaudited – Millions of Dollars, Except Per Share Amounts) CONDENSED STATEMENTS OF EARNINGS |

|||||||||||||||||||||

| Three Months | Six Months | ||||||||||||||||||||

| 2017 | 2016 | % Change | 2017 | 2016 | % Change | ||||||||||||||||

| Net sales | $ | 3,012 | $ | 2,840 | 6.1 | % | $ | 5,967 | $ | 5,335 | 11.8 | % | |||||||||

| Cost of sales | 1,022 | 998 | 2.4 | 2,015 | 1,799 | 12.0 | |||||||||||||||

| Gross profit | $ | 1,990 | $ | 1,842 | 8.0 | % | $ | 3,952 | $ | 3,536 | 11.8 | % | |||||||||

| % of sales | 66.1 | % | 64.9 | % | 66.2 | % | 66.3 | % | |||||||||||||

| Research, development and engineering expenses | 192 | 183 | 4.9 | 384 | 342 | 12.3 | |||||||||||||||

| Selling, general and administrative expenses | 1,130 | 1,043 | 8.3 | 2,232 | 1,987 | 12.3 | |||||||||||||||

| Recall charges | 72 | 28 | 157.1 | 98 | 47 | 108.5 | |||||||||||||||

| Amortization of intangible assets | 95 | 88 | 8.0 | 183 | 141 | 29.8 | |||||||||||||||

| Total operating expenses | $ | 1,489 | $ | 1,342 | 11.0 | % | $ | 2,897 | $ | 2,517 | 15.1 | % | |||||||||

| Operating income | $ | 501 | $ | 500 | 0.2 | % | $ | 1,055 | $ | 1,019 | 3.5 | % | |||||||||

| % of sales | 16.6 | % | 17.6 | % | 17.7 | % | 19.1 | % | |||||||||||||

| Other income (expense), net | (57 | ) | (67 | ) | (14.9 | ) | (112 | ) | (105 | ) | 6.7 | ||||||||||

| Earnings before income taxes | $ | 444 | $ | 433 | 2.5 | % | $ | 943 | $ | 914 | 3.2 | % | |||||||||

| Income taxes | 53 | 53 | – | 108 | 132 | (18.2 | ) | ||||||||||||||

| Net earnings | $ | 391 | $ | 380 | 2.9 | % | $ | 835 | $ | 782 | 6.8 | % | |||||||||

| Net earnings per share of common stock: | |||||||||||||||||||||

| Basic | $ | 1.04 | $ | 1.02 | 2.0 | % | $ | 2.23 | $ | 2.09 | 6.7 | % | |||||||||

| Diluted | $ | 1.03 | $ | 1.00 | 3.0 | % | $ | 2.20 | $ | 2.07 | 6.3 | % | |||||||||

| Weighted-average shares outstanding – in millions: | |||||||||||||||||||||

| Basic | 373.9 | 374.2 | 373.7 | 373.7 | |||||||||||||||||

| Diluted | 379.8 | 378.5 | 379.6 | 378.0 | |||||||||||||||||

| CONDENSED BALANCE SHEETS | |||||||

| June | December | ||||||

| 2017 | 2016 | ||||||

| Assets | |||||||

| Cash and cash equivalents | $ | 3,649 | $ | 3,316 | |||

| Marketable securities | 98 | 68 | |||||

| Accounts receivable, net | 1,905 | 1,967 | |||||

| Inventories | 2,279 | 2,030 | |||||

| Other current assets | 547 | 480 | |||||

| Total current assets | $ | 8,478 | $ | 7,861 | |||

| Property, plant and equipment, net | 1,758 | 1,569 | |||||

| Goodwill and other intangibles, net | 9,853 | 9,864 | |||||

| Other noncurrent assets | 1,203 | 1,141 | |||||

| Total assets | $ | 21,292 | $ | 20,435 | |||

| Liabilities and shareholders’ equity | |||||||

| Current liabilities | $ | 3,014 | $ | 2,554 | |||

| Accrued recall expenses | 538 | 594 | |||||

| Other noncurrent liabilities | 1,113 | 1,051 | |||||

| Long-term debt, excluding current maturities | 6,592 | 6,686 | |||||

| Shareholders’ equity | 10,035 | 9,550 | |||||

| Total liabilities and shareholders’ equity | $ | 21,292 | $ | 20,435 | |||

| CONDENSED STATEMENTS OF CASH FLOWS | |||||||

| Six Months | |||||||

| 2017 | 2016 | ||||||

| Operating activities | |||||||

| Net earnings | $ | 835 | $ | 782 | |||

| Depreciation | 127 | 106 | |||||

| Amortization of intangible assets | 183 | 141 | |||||

| Changes in operating assets and liabilities and other, net | (344 | ) | (274 | ) | |||

| Net cash provided by operating activities | $ | 801 | $ | 755 | |||

| Investing activities | |||||||

| Acquisitions, net of cash acquired | $ | (38 | ) | $ | (4,219 | ) | |

| Change in marketable securities, net | (30 | ) | 536 | ||||

| Purchases of property, plant and equipment | (270 | ) | (229 | ) | |||

| Net cash used in investing activities | $ | (338 | ) | $ | (3,912 | ) | |

| Financing activities | |||||||

| Borrowings/repayments of debt, net | $ | 443 | $ | 3,611 | |||

| Dividends paid | (318 | ) | (284 | ) | |||

| Repurchases of common stock | (230 | ) | (13 | ) | |||

| Other financing | (72 | ) | (56 | ) | |||

| Net cash (used in) provided by financing activities | $ | (177 | ) | $ | 3,258 | ||

| Effect of exchange rate changes on cash and cash equivalents | 47 | 10 | |||||

| Change in cash and cash equivalents | $ | 333 | $ | 111 | |||

| STRYKER CORPORATION

For the Three and Six Months Ended June 30 (Unaudited – Millions of Dollars) CONDENSED SALES ANALYSIS |

|||||||||||||||||||||

| Three Months | Six Months | ||||||||||||||||||||

| Percentage Change | Percentage Change | ||||||||||||||||||||

| 2017 | 2016 | As Reported | Constant

Currency |

2017 | 2016 | As Reported | Constant

Currency |

||||||||||||||

| Geographic: | |||||||||||||||||||||

| United States | $ | 2,201 | $ | 2,050 | 7.4 | % | 7.4 | % | $ | 4,364 | $ | 3,871 | 12.7 | % | 12.7 | % | |||||

| International | 811 | 790 | 2.7 | 5.7 | 1,603 | 1,464 | 9.5 | 11.9 | |||||||||||||

| Total | $ | 3,012 | $ | 2,840 | 6.1 | % | 6.9 | % | $ | 5,967 | $ | 5,335 | 11.8 | % | 12.5 | % | |||||

| Segment: | |||||||||||||||||||||

| Orthopaedics | $ | 1,141 | $ | 1,082 | 5.5 | % | 6.5 | % | $ | 2,276 | $ | 2,139 | 6.4 | % | 7.2 | % | |||||

| MedSurg | 1,336 | 1,258 | 6.2 | 6.8 | 2,641 | 2,216 | 19.2 | 19.7 | |||||||||||||

| Neurotechnology and Spine | 535 | 500 | 6.9 | 7.9 | 1,050 | 980 | 7.1 | 7.8 | |||||||||||||

| Total | $ | 3,012 | $ | 2,840 | 6.1 | % | 6.9 | % | $ | 5,967 | $ | 5,335 | 11.8 | % | 12.5 | % | |||||

| SUPPLEMENTAL SALES GROWTH ANALYSIS | |||||||||||||||||||

| Three Months | |||||||||||||||||||

| Percentage Change | |||||||||||||||||||

| United States | International | ||||||||||||||||||

| 2017 | 2016 | As Reported | Constant Currency | As Reported | As Reported | Constant Currency | |||||||||||||

| Orthopaedics: | |||||||||||||||||||

| Knees | $ | 389 | $ | 370 | 5.0 | % | 5.9 | % | 7.0 | % | 0.1 | % | 3.0 | % | |||||

| Hips | 322 | 323 | (0.3 | ) | 1.0 | 2.1 | (4.3 | ) | (0.8 | ) | |||||||||

| Trauma and Extremities | 351 | 328 | 7.0 | 8.0 | 11.4 | (0.5 | ) | 2.4 | |||||||||||

| Other | 79 | 61 | 32.0 | 32.1 | 34.8 | 20.1 | 20.9 | ||||||||||||

| Total Orthopaedics | $ | 1,141 | $ | 1,082 | 5.5 | % | 6.5 | % | 8.8 | % | (1.0 | )% | 2.1 | % | |||||

| MedSurg: | |||||||||||||||||||

| Instruments | $ | 392 | $ | 377 | 4.1 | % | 4.7 | % | 4.2 | % | 3.6 | % | 6.2 | % | |||||

| Endoscopy | 406 | 357 | 13.9 | 14.3 | 15.5 | 8.4 | 10.2 | ||||||||||||

| Medical | 474 | 465 | 1.6 | 2.4 | 2.3 | (0.7 | ) | 2.8 | |||||||||||

| Sustainability | 64 | 59 | 10.0 | 10.0 | 10.0 | 8.4 | 13.0 | ||||||||||||

| Total MedSurg | $ | 1,336 | $ | 1,258 | 6.2 | % | 6.8 | % | 7.0 | % | 3.4 | % | 6.2 | % | |||||

| Neurotechnology and Spine: | |||||||||||||||||||

| Neurotechnology | $ | 352 | $ | 312 | 12.8 | % | 13.9 | % | 10.3 | % | 17.3 | % | 20.4 | % | |||||

| Spine | 183 | 188 | (2.9 | ) | (2.1 | ) | (1.3 | ) | (7.7 | ) | (4.7 | ) | |||||||

| Total Neurotechnology and Spine | $ | 535 | $ | 500 | 6.9 | % | 7.9 | % | 5.5 | % | 10.0 | % | 13.1 | % | |||||

| Total | $ | 3,012 | $ | 2,840 | 6.1 | % | 6.9 | % | 7.4 | % | 2.7 | % | 5.7 | % | |||||

| Six Months | |||||||||||||||||||

| Percentage Change | |||||||||||||||||||

| United States | International | ||||||||||||||||||

| 2017 | 2016 | As Reported | Constant Currency | As Reported | As Reported | Constant Currency | |||||||||||||

| Orthopaedics: | |||||||||||||||||||

| Knees | $ | 780 | $ | 731 | 6.8 | % | 7.3 | % | 7.2 | % | 5.5 | % | 7.4 | % | |||||

| Hips | 642 | 639 | 0.4 | 1.5 | 2.1 | (2.2 | ) | 0.6 | |||||||||||

| Trauma and Extremities | 703 | 655 | 7.3 | 8.1 | 10.7 | 1.5 | 4.0 | ||||||||||||

| Other | 151 | 114 | 33.0 | 33.0 | 30.5 | 45.2 | 44.6 | ||||||||||||

| Total Orthopaedics | $ | 2,276 | $ | 2,139 | 6.4 | % | 7.2 | % | 8.3 | % | 2.6 | % | 4.9 | % | |||||

| MedSurg: | |||||||||||||||||||

| Instruments | $ | 786 | $ | 742 | 5.9 | % | 6.4 | % | 6.0 | % | 5.7 | % | 8.0 | % | |||||

| Endoscopy | 779 | 685 | 13.8 | 14.0 | 15.0 | 9.4 | 10.7 | ||||||||||||

| Medical | 949 | 672 | 41.2 | 42.3 | 38.9 | 49.8 | 55.2 | ||||||||||||

| Sustainability | 127 | 117 | 8.8 | 8.8 | 8.7 | 27.0 | 28.2 | ||||||||||||

| Total MedSurg | $ | 2,641 | $ | 2,216 | 19.2 | % | 19.7 | % | 18.9 | % | 20.3 | % | 22.9 | % | |||||

| Neurotechnology and Spine: | |||||||||||||||||||

| Neurotechnology | $ | 683 | $ | 613 | 11.3 | % | 12.0 | % | 10.0 | % | 13.7 | % | 15.6 | % | |||||

| Spine | 367 | 367 | 0.1 | 0.6 | 0.5 | (1.3 | ) | 1.1 | |||||||||||

| Total Neurotechnology and Spine | $ | 1,050 | $ | 980 | 7.1 | % | 7.8 | % | 6.1 | % | 9.4 | % | 11.5 | % | |||||

| Total | $ | 5,967 | $ | 5,335 | 11.8 | % | 12.5 | % | 12.7 | % | 9.5 | % | 11.9 | % | |||||

NON-GAAP FINANCIAL MEASURES

We supplement the reporting of our financial information determined under accounting principles generally accepted in the United States (GAAP) with certain non-GAAP financial measures, including percentage sales growth in constant currency; percentage organic sales growth; adjusted gross profit; cost of sales excluding specified items; adjusted selling, general and administrative expenses; adjusted operating income; adjusted effective income tax rate; adjusted net earnings; and adjusted net earnings per diluted share. We believe that these non-GAAP measures provide meaningful information to assist shareholders in understanding our financial results and assessing our prospects for future performance. Management believes percentage sales growth in constant currency and the other adjusted measures described above are important indicators of our operations because they exclude items that may not be indicative of or are unrelated to our core operating results and provide a baseline for analyzing trends in our underlying businesses. Management uses these non-GAAP financial measures for reviewing the operating results of reportable business segments and analyzing potential future business trends in connection with our budget process and bases certain management incentive compensation on these non-GAAP financial measures.

To measure percentage sales growth in constant currency, we remove the impact of changes in foreign currency exchange rates that affect the comparability and trend of sales. Percentage sales growth in constant currency is calculated by translating current and prior year results at the same foreign currency exchange rate. To measure percentage organic sales growth, we remove the impact of changes in foreign currency exchange rates and acquisitions that affect the comparability and trend of sales. Percentage organic sales growth is calculated by translating current and prior year results at the same foreign currency exchange rate excluding the impact of acquisitions. To measure earnings performance on a consistent and comparable basis, we exclude certain items that affect the comparability of operating results and the trend of earnings.

Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. These adjusted financial measures should not be considered in isolation or as a substitute for reported sales growth, gross profit, selling, general and administrative expenses, operating income, effective income tax rate, net earnings and net earnings per diluted share, the most directly comparable GAAP financial measures. These non-GAAP financial measures are an additional way of viewing aspects of our operations when viewed with our GAAP results and the reconciliations to corresponding GAAP financial measures below. We strongly encourage investors and shareholders to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. The following reconciles the non-GAAP financial measures discussed above with the most directly comparable GAAP financial measures:

| STRYKER CORPORATION

For the Three Months and Six Months June 30 (Unaudited – Millions of Dollars, Except Per Share Amounts) Reconciliation of Non-GAAP Financial Measures to the Most Directly Comparable GAAP Financial Measures |

||||||||||||||||||||

| Three Months 2017 | Gross Profit | Selling, General & Administrative Expenses | Amortization of Intangible Assets | Operating Income | Net Earnings | Effective

Tax Rate |

Diluted EPS | |||||||||||||

| Reported | $ | 1,990 | $ | 1,130 | $ | 95 | $ | 501 | $ | 391 | 11.8 | % | $ | 1.03 | ||||||

| Acquisition and integration related charges: (a) | ||||||||||||||||||||

| Inventory stepped-up to fair value | 1 | – | – | 1 | – | 0.1 | – | |||||||||||||

| Other acquisition and integration related | – | (8 | ) | – | 8 | 7 | – | 0.02 | ||||||||||||

| Amortization of purchased intangible assets | – | – | (95 | ) | 95 | 63 | 3.7 | 0.16 | ||||||||||||

| Restructuring-related charges (b) | 6 | (39 | ) | – | 45 | 41 | (0.6 | ) | 0.11 | |||||||||||

| Rejuvenate and other recall matters (c) | – | – | – | 72 | 54 | 1.3 | 0.14 | |||||||||||||

| Legal matters (d) | – | (30 | ) | – | 30 | 25 | – | 0.07 | ||||||||||||

| Adjusted | $ | 1,997 | $ | 1,053 | $ | – | $ | 752 | $ | 581 | 16.3 | % | $ | 1.53 | ||||||

| Three Months 2016 | Gross Profit | Selling, General & Administrative Expenses | Amortization of Intangible Assets | Operating Income | Net Earnings | Effective

Tax Rate |

Diluted EPS | |||||||||||||

| Reported | $ | 1,842 | $ | 1,043 | $ | 88 | $ | 500 | $ | 380 | 12.3 | % | $ | 1.00 | ||||||

| Acquisition and integration related charges: (a) | ||||||||||||||||||||

| Inventory stepped-up to fair value | 35 | – | – | 35 | 22 | 1.6 | 0.06 | |||||||||||||

| Other acquisition and integration related | – | (31 | ) | – | 31 | 21 | 1.0 | 0.06 | ||||||||||||

| Amortization of purchased intangible assets | – | – | (88 | ) | 88 | 59 | 3.1 | 0.16 | ||||||||||||

| Restructuring-related charges (b) | 2 | (20 | ) | – | 22 | 20 | (0.4 | ) | 0.05 | |||||||||||

| Rejuvenate and other recall matters (c) | – | – | – | 28 | 23 | – | 0.06 | |||||||||||||

| Adjusted | $ | 1,879 | $ | 992 | $ | – | $ | 704 | $ | 525 | 17.6 | % | $ | 1.39 | ||||||

| Six Months 2017 | Gross Profit | Selling, General & Administrative Expenses | Amortization of Intangible Assets | Operating Income | Net Earnings | Effective

Tax Rate |

Diluted EPS | |||||||||||||

| Reported | $ | 3,952 | $ | 2,232 | $ | 183 | $ | 1,055 | $ | 835 | 11.4 | % | $ | 2.20 | ||||||

| Acquisition and integration related charges: (a) | ||||||||||||||||||||

| Other acquisition and integration related | – | (18 | ) | – | 18 | 14 | 0.2 | 0.04 | ||||||||||||

| Amortization of purchased intangible assets | – | – | (183 | ) | 183 | 124 | 3.1 | 0.32 | ||||||||||||

| Restructuring-related charges (b) | 11 | (72 | ) | – | 83 | 68 | 0.2 | 0.18 | ||||||||||||

| Rejuvenate and other recall matters (c) | – | – | – | 98 | 75 | 0.9 | 0.20 | |||||||||||||

| Legal matters (d) | – | (30 | ) | – | 30 | 25 | – | 0.07 | ||||||||||||

| Adjusted | $ | 3,963 | $ | 2,112 | $ | – | $ | 1,467 | $ | 1,141 | 15.8 | % | $ | 3.01 | ||||||

| Six Months 2016 | Gross Profit | Selling, General & Administrative Expenses | Amortization of Intangible Assets | Operating Income | Net Earnings | Effective

Tax Rate |

Diluted EPS | |||||||||||||

| Reported | $ | 3,536 | $ | 1,987 | $ | 141 | $ | 1,019 | $ | 782 | 14.5 | % | $ | 2.07 | ||||||

| Acquisition and integration related charges: (a) | ||||||||||||||||||||

| Inventory stepped-up to fair value | 35 | – | – | 35 | 22 | 0.7 | 0.06 | |||||||||||||

| Other acquisition and integration related | – | (36 | ) | – | 36 | 25 | 0.5 | 0.07 | ||||||||||||

| Amortization of purchased intangible assets | – | – | (141 | ) | 141 | 98 | 2.0 | 0.26 | ||||||||||||

| Restructuring-related charges (b) | 5 | (37 | ) | – | 42 | 34 | 0.1 | 0.09 | ||||||||||||

| Rejuvenate and other recall matters (c) | – | – | – | 47 | 39 | – | 0.10 | |||||||||||||

| Legal matters (d) | – | 12 | – | (12 | ) | (7 | ) | (0.3 | ) | (0.02 | ) | |||||||||

| Adjusted | $ | 3,576 | $ | 1,926 | $ | – | $ | 1,308 | $ | 993 | 17.5 | % | $ | 2.63 | ||||||

| (a) | Charges represent certain acquisition and integration related costs associated with acquisitions. |

| (b) | Charges represent the cost associated with certain restructuring-related charges associated with workforce reductions and other restructuring-related activities. |

| (c) | Charges represent changes in our best estimate of the minimum end of the range of probable loss to resolve the Rejuvenate recall and other recall matters. |

| (d) | Amount represents gains or losses associated with legal settlements. |

| STRYKER CORPORATION

For the Three Months September 30, 2017 and Full Year December 31, 2017 Reconciliation of Expected Net Earnings Per Diluted Share to Expected Adjusted Net Earnings per Diluted Share |

|||||||||||||

| Three Months | Full Year | ||||||||||||

| Low | High | Low | High | ||||||||||

| Expected – Reported | $ | 1.15 | $ | 1.28 | $ | 5.05 | $ | 5.25 | |||||

| Acquisition and integration related charges | 0.05 | 0.02 | 0.13 | 0.08 | |||||||||

| Amortization of purchased intangible assets | 0.15 | 0.15 | 0.65 | 0.65 | |||||||||

| Restructuring-related charges | 0.15 | 0.10 | 0.35 | 0.30 | |||||||||

| Rejuvenate and other recall matters | – | – | 0.20 | 0.20 | |||||||||

| Legal matters | – | – | 0.07 | 0.07 | |||||||||

| Expected – Adjusted | $ | 1.50 | $ | 1.55 | $ | 6.45 | $ | 6.55 | |||||

This announcement is distributed by Nasdaq Corporate Solutions on behalf of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely responsible for the content, accuracy and originality of the information contained therein.

Source: Stryker Corporation via Globenewswire