DUBLIN and CAESAREA, Israel – September 20, 2018 – Medtronic plc (NYSE:MDT), a global leader in medical technology, and Mazor Robotics (NASDAQ:MZOR, TASE:MZOR.TZ), a pioneer in the field of robotic guidance systems, today announced the companies have entered into a definitive merger agreement under which Medtronic will acquire all outstanding ordinary shares of Mazor for $58.50 per American Depository Share, or $29.25 (104.80 ILS) per ordinary share, in cash, for a total of approximately $1.64 billion, or $1.34 billion net of Medtronic’s existing stake in Mazor and cash acquired. The boards of directors of both companies have unanimously approved the transaction.

DUBLIN and CAESAREA, Israel – September 20, 2018 – Medtronic plc (NYSE:MDT), a global leader in medical technology, and Mazor Robotics (NASDAQ:MZOR, TASE:MZOR.TZ), a pioneer in the field of robotic guidance systems, today announced the companies have entered into a definitive merger agreement under which Medtronic will acquire all outstanding ordinary shares of Mazor for $58.50 per American Depository Share, or $29.25 (104.80 ILS) per ordinary share, in cash, for a total of approximately $1.64 billion, or $1.34 billion net of Medtronic’s existing stake in Mazor and cash acquired. The boards of directors of both companies have unanimously approved the transaction.

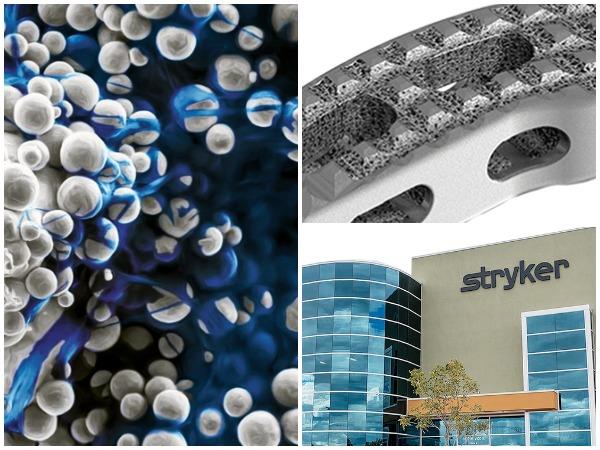

Medtronic’s acquisition of Mazor strengthens Medtronic’s position as a global leader in enabling technologies for spine surgery, and drives Mazor Robotics’ vision to bring its core technology to the forefront of the global market. Mazor’s proprietary core platform technology, including the Mazor X(TM) Robotic Guidance System (Mazor X), and the Renaissance® Surgical-Guidance System (Renaissance), are transforming spinal surgery from freehand procedures to accurate, state-of-the-art, guided procedures. By combining Medtronic’s market-leading spine implants, navigation, and intra-operative imaging technology with Mazor’s robotic-assisted surgery (RAS) systems, Medtronic intends to offer a fully-integrated procedural solution for surgical planning, execution and confirmation. The companies plan to showcase this technology integration at the upcoming NASS (North American Spine Society) 2018 Annual Meeting in Los Angeles.

“We believe robotic-assisted procedures are the future of spine surgery, enhancing surgeons’ abilities to perform complex procedures with greater precision, consistency and control. Medtronic is committed to accelerating the adoption of robotic-assisted surgery and transforming spine care through procedural solutions that integrate implants, biologics and enabling technologies,” said Geoff Martha, executive vice president and president of the Restorative Therapies Group at Medtronic. “The acquisition of Mazor adds robotic-assisted guidance systems to our expanding portfolio of enabling technologies, and we intend to further cultivate Mazor’s legacy of innovation in surgical robotics with the site and team in Israel as a base for future growth.”

This transaction builds on a relationship originated in May 2016 under a multi-phased strategic and equity investment agreement between Medtronic and Mazor. In August 2017, Medtronic expanded the partnership to become the exclusive worldwide distributor of the Mazor X system, leading to the successful installation of more than 80 Mazor X systems since launch. With today’s announcement bringing the two companies together, Medtronic aims to accelerate the advancement and adoption of RAS in spine to the benefit of patients, providers, and the healthcare system more broadly.

“Today is a historic day for spine surgery and a defining event in the market’s evolution, and I want to acknowledge and thank all of those whose contribution and faith have been so critical and impactful to our success,” said Ori Hadomi, CEO of Mazor Robotics. “The Mazor team and product portfolio’s full integration into Medtronic will maximize our impact globally through Medtronic’s channels, advance our systems’ leadership position in the marketplace, and drive the realization of our vision to heal through innovation.”

Financial Highlights

The acquisition is expected to close during Medtronic’s third fiscal quarter ending January 25, 2019, subject to the satisfaction of customary closing conditions including receipt of regulatory clearances and approval by Mazor’s shareholders. The transaction is expected to be modestly dilutive to Medtronic’s fiscal 2019 adjusted earnings per share, but given the current strength of Medtronic’s business, the company expects to absorb the dilution.

Consistent with its long-term financial objectives, Medtronic projects the acquisition to generate a double-digit return on invested capital (ROIC) by year four, with an increasing contribution thereafter.

Medtronic’s financial advisors for the transaction are Perella Weinberg Partners LP and Goldman Sachs & Co. LLC, with Meitar Liquornik Geva Leshem Tal and Ropes & Gray LLP acting as legal advisors. Mazor’s financial advisor is J.P. Morgan Securities LLC, Duff & Phelps LLC, with Kirkland & Ellis LLP and Luchtenstein Levy Wiseman Law office acting as legal advisor.

About Mazor Robotics

Mazor, founded in 2001, pioneered the application of robotics technology and guidance for use during spinal procedures, and is the market segment’s leader. In 2011, the Company introduced the Renaissance system and in 2016 launched the next generation Mazor X system. To date, more than 200 Mazor systems are in clinical use on four continents and have guided the placement of more than 250,000 implants during some 40,000 procedures, enabling minimally-invasive spine surgery to become standard procedure in many hospitals. Mazor’s core technology has received more than 15 U.S. Food and Drug Administration clearances and has been the subject of more than 60 publications, leading the spine robotics market on the evidence front. Mazor is the holder of more than fifty patents worldwide.

About Medtronic

Medtronic plc (www.medtronic.com), headquartered in Dublin, Ireland, is among the world’s largest medical technology, services and solutions companies – alleviating pain, restoring health and extending life for millions of people around the world. Medtronic employs more than 86,000 people worldwide, serving physicians, hospitals and patients in more than 150 countries. The company is focused on collaborating with stakeholders around the world to take healthcare Further, Together.

Any forward-looking statements, including, but not limited to, statements regarding the proposed transaction between Medtronic and Mazor, the expected timetable for completing the transaction, strategic and other potential benefits of the transaction, including meeting Medtronic’s long-term financial metrics for acquisitions, Mazor’s products and product candidates, and other statements about Medtronic or Mazor managements’ future expectations, beliefs, goals, plans or prospects, are subject to risks and uncertainties including, but not limited to, the ability and timing to satisfy conditions to closing including shareholder and regulatory approvals, the impact of the announcement of the transaction on the business, and other risks and uncertainties such as those described in Medtronic’s and Mazor’s reports and other filings with the Securities and Exchange Commission. Actual results may differ materially from anticipated results. Medtronic and Mazor caution investors not to place considerable reliance on the forward-looking statements contained in this press release. These forward-looking statements speak only as of the date of this document, and Medtronic and Mazor undertake no obligation to update or revise any of these statements except to the extent required by law.

ADDITIONAL INFORMATION

In connection with the proposed transaction, Mazor intends to mail a proxy statement to its shareholders and furnish a copy of the proxy statement with the SEC on Form 6-K. Shareholders of Mazor are urged to read the proxy statement and the other relevant material when they become available because they will contain important information about Mazor, Medtronic, the proposed transaction and related matters. Shareholders are urged to carefully read the proxy statement and other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction. The proxy statement (when available) may be obtained for free at the SEC’s website at www.sec.gov. In addition, the proxy statement will be available, without charge, at Mazor’s website at www.mazorrobotics.com.

-end-

Medtronic Contacts:

David T. Young

Public Relations

+1-774-284-2746

Ryan Weispfenning

Investor Relations

+1-763-505-4626

Mazor Contacts:

Eran Gabay – Gelbart Kahana

Israel Public Relations

+972-54-246378

Michael Polyviou – EVC Group

U.S. Public Relations

+1-732-232-6914