August 07, 2017

LEWISVILLE, Texas–(BUSINESS WIRE)–Orthofix International N.V. (NASDAQ:OFIX) today reported its financial results for the second quarter ended June 30, 2017. Net sales were $108.9 million, diluted earnings per share from continuing operations was $0.26 and adjusted earnings per share from continuing operations was $0.42.

“The key take-away from the second quarter is the strong sales performance of our Biologics and Spine Fixation businesses. Both have averaged mid-single digit year-over-year growth over the last three quarters,” said Brad Mason, President and Chief Executive Officer. “We believe these growth rates are sustainable in both businesses due to the renewed engagement of our sales partners, the addition of new distributors in underserved markets and our flow of new products to the field.

“The BioStim and Extremity Fixation businesses also performed better than we expected in the second quarter with BioStim delivering another solid top line performance and, when excluding planned subsidiary restructuring and the loss of sales due to the discontinuation of a non-core business last year, Extremity Fixation delivered good constant currency growth.

“Our bottom line performance was in line with our expectations for the period. Our primary focus this year is investing in the areas necessary to support a sustainable increase to our top line growth rate, rather than margin expansion. As we move into next year, without sacrificing our top line growth, we expect to return to adjusted EBITDA margin expansion as a result of a number of opportunities we see across the P&L.”

Financial Results Overview

The following table provides net sales by strategic business unit (“SBU”):

| Three Months Ended June 30, | |||||||||||||||||

| (Unaudited, U.S. Dollars, in thousands) | 2017 | 2016 | Change |

Constant |

|||||||||||||

| BioStim | $ | 47,174 | $ | 44,758 | 5.4 | % | 5.4 | % | |||||||||

| Biologics | 15,661 | 14,256 | 9.9 | % | 9.9 | % | |||||||||||

| Extremity Fixation | 24,747 | 26,817 | (7.7 | %) | (6.0 | %) | |||||||||||

| Spine Fixation | 21,360 | 18,244 | 17.1 | % | 17.1 | % | |||||||||||

| Net sales | $ | 108,942 | $ | 104,075 | 4.7 | % | 5.1 | % | |||||||||

Gross profit increased $4.2 million to $85.8 million. Gross margin improved slightly to 78.7% compared to 78.4% in the prior year period, which was slightly below our expectations due primarily to larger than usual inventory reserve expenses. Non-GAAP net margin, an internal metric that we define as gross profit less sales and marketing expenses, was $35.3 million compared to $35.5 million in the prior year period. The decrease in non-GAAP net margin was primarily due to higher sales and marketing expenses in Biologics and Extremity Fixation.

Net income from continuing operations was $4.7 million, or $0.26 per share, compared to net loss of ($6.3) million, or ($0.35) per share in the prior year period. Adjusted net income from continuing operations was $7.8 million, or $0.42 per share, compared to adjusted net income of $7.5 million, or $0.40 per share in the prior year period.

EBITDA was $14.0 million, compared to $2.6 million in the prior year period. Adjusted EBITDA was $20.5 million, or 18.8% of net sales, for the second quarter, compared to $19.2 million, or 18.5% of net sales, in the prior year period.

Liquidity

As of June 30, 2017, cash and cash equivalents were $44.3 million compared to $39.6 million as of December 31, 2016. As of June 30, 2017, we had no outstanding indebtedness and borrowing capacity of $125 million. Cash flow from operations decreased $11.6 million to $9.7 million and free cash flow decreased $9.9 million to $1.1 million.

2017 Outlook

For the year ending December 31, 2017, the Company expects the following results, assuming exchange rates are the same as those currently prevailing.

| Previous 2017 Outlook | Current 2017 Outlook | ||||||||||||||||||||

| (Unaudited, U.S. Dollars, in millions, except per share data) | Low | High | Low | High | |||||||||||||||||

| Net sales | $ | 411.0 | $ | 415.0 | $ | 422.0 |

(1) |

$ | 425.0 |

(1) |

|||||||||||

| Net income from continuing operations | $ | 20.6 | $ | 23.7 | $ | 17.7 |

(2) |

$ | 21.4 |

(2) |

|||||||||||

| Adjusted EBITDA | $ | 76.0 | $ | 79.0 | $ | 79.0 |

(3) |

$ | 81.0 |

(3) |

|||||||||||

| EPS from continuing operations | $ | 1.12 | $ | 1.29 | $ | 0.96 |

(4) |

$ | 1.16 |

(4) |

|||||||||||

| Adjusted EPS from continuing operations | $ | 1.48 | $ | 1.58 | $ | 1.54 |

(5) |

$ | 1.60 |

(5) |

|||||||||||

1 Represents a year-over-year increase of 3.0% to 3.7% on a reported basis

2 Represents a year-over-year increase of 406.1% to 512.0%

3 Represents a year-over-year decrease of 0.4% to an increase of 2.1%

4 Represents a year-over-year increase of 405.3% to 510.5%

5 Represents a year-over-year increase of 5.5% to 9.6%

Conference Call

Orthofix will host a conference call today at 4:30 PM Eastern time to discuss the Company’s financial results for the second quarter of 2017. Interested parties may access the conference call by dialing (800) 406-5345 in the U.S. and (719) 325-4807 outside the U.S., and referencing the conference ID 7718902. A replay of the call will be available for two weeks by dialing (888) 203-1112 in the U.S. and (719) 457-0820 outside the U.S., and entering the conference ID 7718902. A webcast of the conference call may be accessed by going to the Company’s website at www.orthofix.com, by clicking on the Investors link and then the Events and Presentations page.

About Orthofix

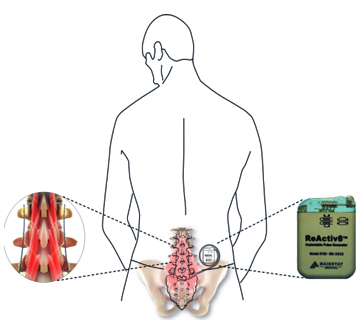

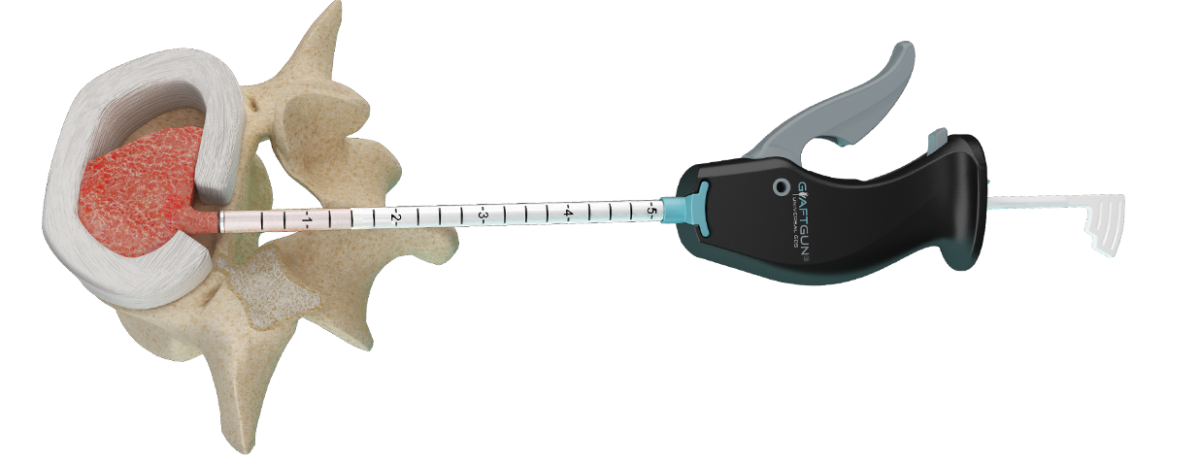

Orthofix International N.V. is a diversified, global medical device company focused on improving patients’ lives by providing superior reconstructive and regenerative orthopedic and spine solutions to physicians worldwide. Headquartered in Lewisville, Texas, the Company has four strategic business units: BioStim, Biologics, Extremity Fixation and Spine Fixation. Orthofix products are widely distributed via the Company’s sales representatives and distributors. In addition, Orthofix is collaborating on research and development activities with leading clinical organizations such as Brown University, Sinai Hospital of Baltimore, Cleveland Clinic, Texas Scottish Rite Hospital for Children, and the Musculoskeletal Transplant Foundation. For more information, please visit www.orthofix.com.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (“the Exchange Act”), and Section 27A of the Securities Act of 1933, as amended, relating to our business and financial outlook, which are based on our current beliefs, assumptions, expectations, estimates, forecasts and projections. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “intends,” “predicts,” “potential,” or “continue” or other comparable terminology. These forward-looking statements are not guarantees of our future performance and involve risks, uncertainties, estimates and assumptions that are difficult to predict. Therefore, our actual outcomes and results may differ materially from those expressed in these forward-looking statements. You should not place undue reliance on any of these forward-looking statements. Further, any forward-looking statement speaks only as of the date hereof, unless it is specifically otherwise stated to be made as of a different date. We undertake no obligation to further update any such statement, or the risk factors described in Part I, Item 1A under the heading Risk Factors in our Form 10-K for the year ended December 31, 2016, to reflect new information, the occurrence of future events or circumstances or otherwise.

| ORTHOFIX INTERNATIONAL N.V. | |||||||||||||||||||||

| Condensed Consolidated Statements of Operations | |||||||||||||||||||||

| Three Months Ended | Six Months Ended | ||||||||||||||||||||

| June 30, | June 30, | ||||||||||||||||||||

| (Unaudited, U.S. Dollars, in thousands, except share and per share data) | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||

| Net sales | $ | 108,942 | $ | 104,075 | $ | 211,680 | $ | 202,754 | |||||||||||||

| Cost of sales | 23,177 | 22,516 | 45,758 | 44,653 | |||||||||||||||||

| Gross profit | 85,765 | 81,559 | 165,922 | 158,101 | |||||||||||||||||

| Sales and marketing | 50,471 | 46,043 | 99,003 | 90,865 | |||||||||||||||||

| General and administrative | 20,409 | 18,545 | 38,691 | 35,550 | |||||||||||||||||

| Research and development | 6,887 | 6,796 | 14,311 | 14,436 | |||||||||||||||||

| Charges related to U.S. Government resolutions | — | 12,870 | — | 12,870 | |||||||||||||||||

| Operating income (loss) | 7,998 | (2,695 | ) | 13,917 | 4,380 | ||||||||||||||||

| Interest income (expense), net | 76 | (113 | ) | 121 | (151 | ) | |||||||||||||||

| Other income (expense), net | 585 | 147 | (3,763 | ) | 1,980 | ||||||||||||||||

| Income (loss) before income taxes | 8,659 | (2,661 | ) | 10,275 | 6,209 | ||||||||||||||||

| Income tax expense | (3,924 | ) | (3,685 | ) | (7,848 | ) | (7,979 | ) | |||||||||||||

| Net income (loss) from continuing operations | 4,735 | (6,346 | ) | 2,427 | (1,770 | ) | |||||||||||||||

| Discontinued operations | |||||||||||||||||||||

| Loss from discontinued operations | (1,300 | ) | (1,572 | ) | (1,827 | ) | (2,562 | ) | |||||||||||||

| Income tax benefit | 418 | 474 | 599 | 728 | |||||||||||||||||

| Net loss from discontinued operations | (882 | ) | (1,098 | ) | (1,228 | ) | (1,834 | ) | |||||||||||||

| Net income (loss) | $ | 3,853 | $ | (7,444 | ) | $ | 1,199 | $ | (3,604 | ) | |||||||||||

| Net income (loss) per common share—basic | |||||||||||||||||||||

| Net income (loss) from continuing operations | $ | 0.26 | $ | (0.35 | ) | $ | 0.13 | $ | (0.10 | ) | |||||||||||

| Net loss from discontinued operations | (0.05 | ) | (0.06 | ) | (0.06 | ) | (0.10 | ) | |||||||||||||

| Net income (loss) per common share—basic | $ | 0.21 | $ | (0.41 | ) | $ | 0.07 | $ | (0.20 | ) | |||||||||||

| Net income (loss) per common share—diluted | |||||||||||||||||||||

| Net income (loss) from continuing operations | $ | 0.26 | $ | (0.35 | ) | $ | 0.13 | $ | (0.10 | ) | |||||||||||

| Net loss from discontinued operations | (0.05 | ) | (0.06 | ) | (0.06 | ) | (0.10 | ) | |||||||||||||

| Net income (loss) per common share—diluted | $ | 0.21 | $ | (0.41 | ) | $ | 0.07 | $ | (0.20 | ) | |||||||||||

| Weighted average number of common shares: | |||||||||||||||||||||

| Basic | 18,050,551 | 18,147,681 | 18,015,308 | 18,312,781 | |||||||||||||||||

| Diluted | 18,343,038 | 18,147,681 | 18,288,050 | 18,312,781 | |||||||||||||||||

| ORTHOFIX INTERNATIONAL N.V. | |||||||||||

| Condensed Consolidated Balance Sheets | |||||||||||

| (U.S. Dollars, in thousands except share data) | June 30,

2017 |

December 31,

2016 |

|||||||||

| (unaudited) | |||||||||||

| Assets | |||||||||||

| Current assets | |||||||||||

| Cash and cash equivalents | $ | 44,330 | $ | 39,572 | |||||||

| Restricted cash | — | 14,369 | |||||||||

| Accounts receivable, net of allowances of $8,480 and $8,396, respectively | 61,213 | 57,848 | |||||||||

| Inventories | 75,869 | 63,346 | |||||||||

| Prepaid expenses and other current assets | 17,192 | 19,238 | |||||||||

| Total current assets | 198,604 | 194,373 | |||||||||

| Property, plant and equipment, net | 46,651 | 48,916 | |||||||||

| Patents and other intangible assets, net | 9,508 | 7,461 | |||||||||

| Goodwill | 53,565 | 53,565 | |||||||||

| Deferred income taxes | 42,685 | 47,325 | |||||||||

| Other long-term assets | 16,664 | 20,463 | |||||||||

| Total assets | $ | 367,677 | $ | 372,103 | |||||||

| Liabilities and shareholders’ equity | |||||||||||

| Current liabilities | |||||||||||

| Accounts payable | $ | 14,245 | $ | 14,353 | |||||||

| Other current liabilities | 50,858 | 69,088 | |||||||||

| Total current liabilities | 65,103 | 83,441 | |||||||||

| Other long-term liabilities | 25,627 | 25,185 | |||||||||

| Total liabilities | 90,730 | 108,626 | |||||||||

| Contingencies | |||||||||||

| Shareholders’ equity | |||||||||||

| Common shares $0.10 par value; 50,000,000 shares authorized; 18,119,430 and

17,828,155 issued and outstanding as of June 30, 2017 and December 31, 2016, respectively |

1,812 | 1,783 | |||||||||

| Additional paid-in capital | 211,990 | 204,095 | |||||||||

| Retained earnings | 65,378 | 64,179 | |||||||||

| Accumulated other comprehensive loss | (2,233 | ) | (6,580 | ) | |||||||

| Total shareholders’ equity | 276,947 | 263,477 | |||||||||

| Total liabilities and shareholders’ equity | $ | 367,677 | $ | 372,103 | |||||||

ORTHOFIX INTERNATIONAL N.V.

Non-GAAP Financial Measures

The following tables present reconciliations of net income (loss) from continuing operations, earnings per share (“EPS”) from continuing operations, gross profit, and net cash from operating activities, in each case calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), to, as applicable, non-GAAP financial measures, referred to as “EBITDA,” “Adjusted EBITDA,” “Adjusted net income from continuing operations,” “Adjusted earnings per share from continuing operations,” “Non-GAAP net margin” and “Free cash flow” that exclude items specified in the tables. A more detailed explanation of the items excluded from these non-GAAP financial measures, as well as why management believes the non-GAAP financial measures are useful to them, is included following the reconciliations.

|

EBITDA and Adjusted EBITDA |

|||||||||||||||||||||

| Three Months Ended

June 30, |

Six Months Ended

June 30, |

||||||||||||||||||||

| (Unaudited, U.S. Dollars, in thousands) | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||

| Net income (loss) from continuing operations | $ | 4,735 | $ | (6,346 | ) | $ | 2,427 | $ | (1,770 | ) | |||||||||||

| Interest expense (income), net | (76 | ) | 113 | (121 | ) | 151 | |||||||||||||||

| Income tax expense | 3,924 | 3,685 | 7,848 | 7,979 | |||||||||||||||||

| Depreciation and amortization | 5,372 | 5,130 | 10,447 | 10,003 | |||||||||||||||||

| EBITDA | $ | 13,955 | $ | 2,582 | $ | 20,601 | $ | 16,363 | |||||||||||||

| Share-based compensation | 2,676 | 1,913 | 5,492 | 4,012 | |||||||||||||||||

| Foreign exchange impact | (618 | ) | (185 | ) | (1,631 | ) | (2,000 | ) | |||||||||||||

| Strategic investments | 2,226 | 206 | 9,326 | 404 | |||||||||||||||||

| SEC / FCPA matters and related costs | 560 | 545 | 701 | 790 | |||||||||||||||||

| Infrastructure investments | — | 1,284 | — | 2,246 | |||||||||||||||||

| Legal judgments/settlements | 1,392 | — | 1,619 | — | |||||||||||||||||

| International restructuring | 321 | — | 82 | — | |||||||||||||||||

| Charges related to U.S. Government resolutions | — | 12,870 | — | 12,870 | |||||||||||||||||

| Adjusted EBITDA | $ | 20,512 | $ | 19,215 | $ | 36,190 | $ | 34,685 | |||||||||||||

| As a % of net sales | 18.8 | % | 18.5 | % | 17.1 | % | 17.1 | % | |||||||||||||

|

Adjusted Net Income from Continuing Operations |

|||||||||||||||||||||

| Three Months Ended

June 30, |

Six Months Ended

June 30, |

||||||||||||||||||||

| (Unaudited, U.S. Dollars, in thousands) | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||

| Net income (loss) from continuing operations | $ | 4,735 | $ | (6,346 | ) | $ | 2,427 | $ | (1,770 | ) | |||||||||||

| Foreign exchange impact | (618 | ) | (185 | ) | (1,631 | ) | (2,000 | ) | |||||||||||||

| Strategic investments | 2,226 | 206 | 9,326 | 404 | |||||||||||||||||

| SEC / FCPA matters and related costs | 560 | 545 | 701 | 790 | |||||||||||||||||

| Infrastructure investments | — | 1,284 | — | 2,246 | |||||||||||||||||

| Legal judgments/settlements | 1,392 | — | 1,619 | — | |||||||||||||||||

| International restructuring | 321 | — | 82 | — | |||||||||||||||||

| Charges related to U.S. Government resolutions | — | 12,870 | — | 12,870 | |||||||||||||||||

| Long-term income tax rate adjustment | (841 | ) | (897 | ) | 107 | 182 | |||||||||||||||

| Adjusted net income from continuing operations | $ | 7,775 | $ | 7,477 | $ | 12,631 | $ | 12,722 | |||||||||||||

|

Adjusted Earnings per Share from Continuing Operations |

|||||||||||||||||||||

| Three Months Ended

June 30, |

Six Months Ended

June 30, |

||||||||||||||||||||

| (Unaudited, per diluted share) | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||

| EPS from continuing operations | $ | 0.26 | $ | (0.35 | ) | $ | 0.13 | $ | (0.10 | ) | |||||||||||

| Foreign exchange impact | (0.03 | ) | (0.01 | ) | (0.09 | ) | (0.11 | ) | |||||||||||||

| Strategic investments | 0.12 | 0.01 | 0.51 | 0.02 | |||||||||||||||||

| SEC / FCPA matters and related costs | 0.03 | 0.03 | 0.04 | 0.04 | |||||||||||||||||

| Infrastructure investments | — | 0.07 | — | 0.12 | |||||||||||||||||

| Legal judgments/settlements | 0.08 | — | 0.09 | — | |||||||||||||||||

| International restructuring | 0.02 | — | — | — | |||||||||||||||||

| Charges related to U.S. Government resolutions | — | 0.70 | — | 0.69 | |||||||||||||||||

| Long-term income tax rate adjustment | (0.06 | ) | (0.05 | ) | 0.01 | 0.02 | |||||||||||||||

| Adjusted EPS from continuing operations | $ | 0.42 | $ | 0.40 | $ | 0.69 | $ | 0.68 | |||||||||||||

| Weighted average number of diluted common shares | 18,343,038 | 18,511,978 | 18,288,050 | 18,645,280 | |||||||||||||||||

|

Non-GAAP Net Margin |

|||||||||||||||||||||

| Three Months Ended

June 30, |

Six Months Ended

June 30, |

||||||||||||||||||||

| (Unaudited, U.S. Dollars, in thousands) | 2017 | 2016 | 2017 | 2016 | |||||||||||||||||

| Gross profit | $ | 85,765 | $ | 81,559 | $ | 165,922 | $ | 158,101 | |||||||||||||

| Sales and marketing | (50,471 | ) | (46,043 | ) | (99,003 | ) | (90,865 | ) | |||||||||||||

| Non-GAAP net margin | $ | 35,294 | $ | 35,516 | $ | 66,919 | $ | 67,236 | |||||||||||||

| BioStim | $ | 19,469 | $ | 18,575 | $ | 36,602 | $ | 34,983 | |||||||||||||

| Biologics | 6,470 | 6,718 | 12,641 | 12,822 | |||||||||||||||||

| Extremity Fixation | 6,766 | 8,161 | 13,178 | 15,336 | |||||||||||||||||

| Spine Fixation | 2,696 | 2,201 | 4,703 | 4,536 | |||||||||||||||||

| Corporate | (107 | ) | (139 | ) | (205 | ) | (441 | ) | |||||||||||||

| Non-GAAP net margin | $ | 35,294 | $ | 35,516 | $ | 66,919 | $ | 67,236 | |||||||||||||

|

Free Cash Flow |

|||||||||||

| Six Months Ended

June 30, |

|||||||||||

| (Unaudited, U.S. Dollars, in thousands) | 2017 | 2016 | |||||||||

| Net cash from operating activities | $ | 9,727 | $ | 21,373 | |||||||

| Capital expenditures | (8,593 | ) | (10,356 | ) | |||||||

| Free cash flow | $ | 1,134 | $ | 11,017 | |||||||

|

2017 Outlook |

|||||||||||||||||||||

| Previous 2017 Outlook | Current 2017 Outlook | ||||||||||||||||||||

| (Unaudited, U.S. Dollars, in millions) | Low | High | Low | High | |||||||||||||||||

| Net income from continuing operations | $ | 20.6 | $ | 23.7 | $ | 17.7 | $ | 21.4 | |||||||||||||

| Interest expense, net | 0.1 | 0.2 | 0.2 | 0.1 | |||||||||||||||||

| Income tax expense | 13.6 | 14.3 | 15.7 | 15.5 | |||||||||||||||||

| Depreciation and amortization | 20.0 | 20.0 | 20.0 | 20.0 | |||||||||||||||||

| EBITDA | $ | 54.3 | $ | 58.2 | $ | 53.6 | $ | 57.0 | |||||||||||||

| Share-based compensation | 11.8 | 11.8 | 13.0 | 13.0 | |||||||||||||||||

| Foreign exchange impact | (1.0 | ) | (1.0 | ) | (1.6 | ) | (1.6 | ) | |||||||||||||

| Strategic investments | 8.6 | 8.1 | 10.3 | 9.3 | |||||||||||||||||

| SEC / FCPA matters and related costs | 1.3 | 1.0 | 1.2 | 1.0 | |||||||||||||||||

| International restructuring | 0.8 | 0.7 | 0.9 | 0.7 | |||||||||||||||||

| Legal judgments/settlements | 0.2 | 0.2 | 1.6 | 1.6 | |||||||||||||||||

| Adjusted EBITDA | $ | 76.0 | $ | 79.0 | $ | 79.0 | $ | 81.0 | |||||||||||||

| Previous 2017 Outlook | Current 2017 Outlook | ||||||||||||||||||||

| (Unaudited, per diluted share) | Low | High | Low | High | |||||||||||||||||

| EPS from continuing operations | $ | 1.12 | $ | 1.29 | $ | 0.96 | $ | 1.16 | |||||||||||||

| Foreign exchange impact | (0.05 | ) | (0.05 | ) | (0.09 | ) | (0.09 | ) | |||||||||||||

| Strategic investments | 0.46 | 0.44 | 0.56 | 0.51 | |||||||||||||||||

| SEC / FCPA matters and related costs | 0.07 | 0.05 | 0.07 | 0.05 | |||||||||||||||||

| International restructuring | 0.04 | 0.04 | 0.05 | 0.04 | |||||||||||||||||

| Legal judgments/settlements | 0.01 | 0.01 | 0.09 | 0.09 | |||||||||||||||||

| Long-term income tax rate adjustment | (0.17 | ) | (0.20 | ) | (0.10 | ) | (0.16 | ) | |||||||||||||

| Adjusted EPS from continuing operations | $ | 1.48 | $ | 1.58 | $ | 1.54 | $ | 1.60 | |||||||||||||

| Weighted average number of diluted common shares | 18,400,000 | 18,400,000 | 18,400,000 | 18,400,000 | |||||||||||||||||

Non-GAAP Measures:

Constant Currency

Constant currency is a non-GAAP measure, which is calculated by using foreign currency rates from the comparable, prior-year period, to present net sales at comparable rates. Constant currency can be presented for numerous GAAP measures, but is most commonly used by management to analyze net sales without the impact of changes in foreign currency rates.

EBITDA

EBITDA is a non-GAAP financial measure, which is calculated by adding interest income (expense), net; income tax expense; and depreciation and amortization to net income (loss) from continuing operations. EBITDA provides management with additional insight to its results of operations.

Adjusted EBITDA, Adjusted Net Income from Continuing Operations and Adjusted Earnings per Share from Continuing Operations

These non-GAAP financial measures provide management with additional insight to its results of operations and are calculated using the following adjustments:

- Share-based compensation – costs related to our share-based compensation plans, which include stock options, restricted stock awards, performance-based restricted stock awards, market-based restricted stock awards and our stock purchase plan

- Foreign exchange impact – gains and losses related to foreign currency transactions; guidance presented does not include the impact of any future foreign exchange fluctuations

- Strategic investments – costs related to our strategic investments, including our investment in eNeura, Inc.

- SEC / FCPA matters and related costs – legal and other professional fees associated with the SEC Investigation, Securities Class Action Complaint and Brazil subsidiary compliance review

- Infrastructure investments – costs associated with our multi-year process and systems improvement effort, “Bluecore,” which was completed in 2016

- Legal judgments/settlements – adverse or favorable legal judgments or negotiated legal settlements

- International restructuring – costs related to a planned restructuring, primarily consisting of severance charges and the write-down of certain assets

- Charges related to U.S. Government resolutions – charges related to the settlement with the SEC as further discussed in our Form 10-K for the year ended December 31, 2016

- Long-term income tax rate adjustment – reflects management’s expectation of a long-term normalized effective tax rate of 38%, which is based on current tax law and current expected income; actual tax expense will ultimately be based on GAAP performance and may differ from the 38% effective tax rate due to a variety of factors, including the jurisdictions in which profits are determined to be earned and taxed, the resolutions of issues arising from tax audits with various tax authorities, and the ability to realize deferred tax assets

Non-GAAP Net Margin

Non-GAAP net margin is an internal non-GAAP metric, which we define as gross profit less sales and marketing expense. Non-GAAP net margin is the primary metric used by our Chief Operating Decision Maker in managing our business.

Free Cash Flow

Free cash flow is a non-GAAP financial measure, which is calculated by subtracting capital expenditures from cash flow from operating activities. Free cash flow is an important indicator of how much cash is generated or used by our normal business operations, including capital expenditures. Management uses free cash flow as a measure of progress on its capital efficiency and cash flow initiatives.

Usefulness and Limitations of Non-GAAP Financial Measures

Management uses non-GAAP measures to evaluate performance period-over-period, to analyze the underlying trends in our business, to assess performance relative to competitors and to establish operational goals and forecasts that are used in allocating resources. Management uses these non-GAAP measures as the basis for assessing the ability of the underlying operations to generate cash. In addition, management uses these non-GAAP measures to further its understanding of the performance of our business units.

Material Limitations Associated with the Use of Non-GAAP Financial Measures

The non-GAAP measures used in this press release may have limitations as analytical tools, and should not be considered in isolation or as a replacement for GAAP financial measures. Some of the limitations associated with the use of these non-GAAP financial measures are that they exclude items that reflect an economic cost and can have a material effect on cash flows. Similarly, certain non-cash expenses, such as share-based compensation, do not directly impact cash flows, but are part of total compensation costs accounted for under GAAP.

Compensation for Limitations Associated with Use of Non-GAAP Financial Measures

We compensate for the limitations of our non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance. The GAAP results provide the ability to understand our performance based on a defined set of criteria. The non-GAAP measures reflect the underlying operating results of our businesses, which we believe is an important measure of our overall performance. We provide a detailed reconciliation of the non-GAAP financial measures to our most directly comparable GAAP measures, and encourage investors to review this reconciliation.

Usefulness of Non-GAAP Financial Measures to Investors

We believe that providing non-GAAP financial measures that exclude certain items provides investors with greater transparency to the information used by senior management in its financial and operational decision-making. Management believes it is important to provide investors with the same non-GAAP metrics it uses to supplement information regarding the performance and underlying trends of our business operations in order to facilitate comparisons to its historical operating results and internally evaluate the effectiveness of our operating strategies. Disclosure of these non-GAAP financial measures also facilitates comparisons of our underlying operating performance with other companies in the industry that also supplement their GAAP results with non-GAAP financial measures.

Contacts

Orthofix International N.V.

Mark Quick, 214-937-2924

markquick@orthofix.com