SAN DIEGO–(BUSINESS WIRE)–DJO Global, Inc. (“DJO” or the “Company”), a leading global provider of medical technologies designed to get and keep people moving, today announced financial results for its public reporting subsidiary, DJO Finance LLC (“DJOFL”), for the second quarter ended June 30, 2018.

On January 1, 2018, DJO adopted Accounting Standards Update 2014-09, Revenue From Contracts with Customers, (ASC 606). As a result of the adoption, in the second quarter the Company reclassified $5.4 million of year-to-date costs from selling, general and administrative costs to net sales. The table below summarizes net sales and growth rates with, and without, the adoption of ASC 606.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $000’s |

|

|

|

Q2 2018 Net Sales Overview

|

|

|

|

|

Including ASC 606 Adoption |

|

|

|

Excluding ASC 606 Adoption |

|

|

|

|

Currency |

|

|

|

|

Constant |

|

|

|

|

Revenue |

|

|

|

Growth |

|

|

|

Revenue |

|

|

|

|

Growth |

|

|

|

|

Impact |

|

|

|

|

Currency |

| Surgical |

|

|

|

$ |

53,918 |

|

|

|

7.9 |

% |

|

|

|

$ |

53,918 |

|

|

|

|

7.9 |

% |

|

|

|

|

0.0 |

% |

|

|

|

|

7.9 |

% |

| International |

|

|

|

|

86,953 |

|

|

|

9.3 |

% |

|

|

|

|

86,953 |

|

|

|

|

9.3 |

% |

|

|

|

|

5.8 |

% |

|

|

|

|

3.5 |

% |

| Recovery Sciences |

|

|

|

|

37,454 |

|

|

|

-3.4 |

% |

|

|

|

|

37,454 |

|

|

|

|

-3.4 |

% |

|

|

|

|

0.0 |

% |

|

|

|

|

-3.4 |

% |

| Bracing and Vascular |

|

|

|

|

126,512 |

|

|

|

0.1 |

% |

|

|

|

|

131,942 |

|

|

|

|

4.4 |

% |

|

|

|

|

0.0 |

% |

|

|

|

|

4.4 |

% |

| Total DJO Global |

|

|

|

$ |

304,837 |

|

|

|

3.4 |

% |

|

|

|

$ |

310,267 |

|

|

|

|

5.3 |

% |

|

|

|

|

1.6 |

% |

|

|

|

|

3.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter Highlights

- Net sales grew 5.3% to $310.3 million, or $304.8 million as reported with the adoption of ASC 606, compared to $294.7 million in the prior year period.

- Operating income increased 296% to $35.8 million from $9.0 million in the prior year period.

- Net loss attributable to DJOFL was $13.7 million, compared to a net loss of $34.4 million in the prior year period.

- Adjusted EBITDA continued to expand, increasing 19.0% over the prior year quarter to $75.6 million.

Business Transformation

- The previously announced business transformation continues to drive profitability, pushing Adjusted EBITDA margins up 280 basis points (excluding the impact of ASC 606 adoption) in the second quarter of 2018 compared to the prior year, and remains on track to deliver 7% to 10% annual cost reductions by end of 2018.

- Including $24.8 million in future annual run-rate savings from transformation actions taken to date, Adjusted EBITDA for the twelve months ended June 30 was $312.6 million.

“We executed well in the second quarter, continuing to deliver sustainable value from our transformation efforts, accelerating new product introductions and overcoming market headwinds on elective procedures,” said Brady Shirley, DJO’s President and Chief Executive Officer. “I am encouraged by the momentum in our revenue growth and expanding margins, and continue to anticipate a stronger trajectory for the balance of our fiscal year.”

Mike Eklund, Chief Financial Officer and Chief Operating Officer of DJO, added, “We continue to work aggressively toward our profitability goals and are realizing the benefits, with Adjusted EBITDA for the quarter increasing 19%, or 3.6 times the growth in revenue, and margins improving about 280 basis points. Our team has worked hard on our transformation initiatives to improve operational efficiency, service levels and customer experience. This quarter’s financial metrics are continued indicators of our success.”

Sales Results

Net sales for DJOFL for the second quarter of 2018 were $310.3 million, an increase of 5.3% from the prior year period, or $304.8 million with the adoption of ASC 606. On a constant currency basis, sales increased 3.7%. For the six months ending June 30, 2018, net sales increased 3.4% to $602.9 million, or $597.5 million with the adoption of ASC 606. On a constant currency basis, net sales for the first half of 2018 increased 1.1% over net sales in the first half of 2017. The number of selling days in the quarter was the same as in the prior year period.

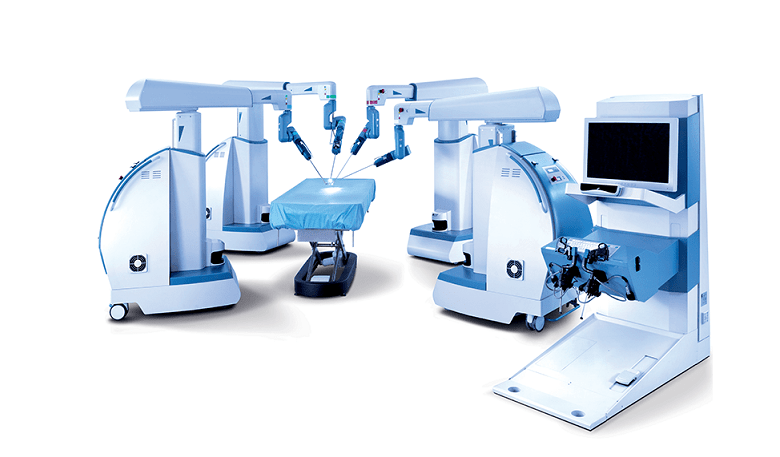

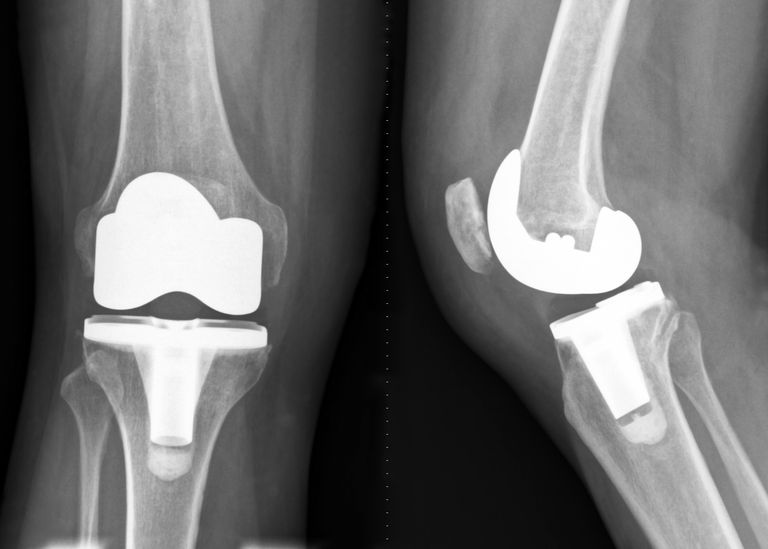

Net sales for DJO’s Surgical Implant segment grew 7.9% in the quarter to $53.9 million. The company’s shoulder implant product line was a key contributor with strong double-digit growth compared to the same quarter in the prior year. For the six months ending June 30, 2018, the Surgical Implant segment grew 8.0% over the prior year period to $107.5 million.

Net sales for DJO’s International segment grew 9.3% in the second quarter to $87.0 million, or 3.5% on a constant currency basis. The company’s sales growth in Germany, France and Australia were partially offset by market conditions in Canada and the United Kingdom. For the six months ending June 30, 2018, the International segment revenue was $175.6 million, an increase of 11.3%, or 2.8% on a constant currency basis.

Net sales for DJO’s Recovery Sciences segment were $37.5 million in the second quarter, a year-over-year decrease of 3.4%. Strong growth in the segment’s Regeneration CMF product line was offset by softness in the Chattanooga product line compared to the prior year period. For the six months ending June 30, 2018, the Recovery Sciences segment declined 5.1% to $73.3 million.

Net sales for DJO’s Bracing and Vascular segment grew 4.4% to $131.9 million in the second quarter, or $126.5 with the adoption of ASC 606. There was strong growth in the segment’s DonJoy product line, partially offset by weakness in the Dr. Comfort footwear product line. Strong demand for new products, strength in acute care and continued progress in transformation initiatives to improve service levels contributed to the results. For the six months ending June 30, 2018, Bracing and Vascular net sales were $246.4 million, a decline of 0.8% from the first half of 2017, or $241.0 million with the adoption of ASC 606.

Earnings Results

Operating income was $35.8 million in the quarter, an increase of 296% over the prior year period. For the six months ending June 30, 2018, operating income was $69.3 million, an increase of 341% over the prior year. Net loss attributable to DJOFL was $13.7 million in the quarter compared to $34.4 million in the prior year period. For the six months ended June 30, net loss was $31.3 million compared to $74.4 million in the six month ended July 1, 2017.

Adjusted EBITDA for the second quarter was $75.6 million, an increase of 19.0% from the prior year period, or 17.0% on the basis of constant currency. For the six months ended June 30, 2018, Adjusted EBITDA was $140.4 million, up 16.2% from the prior year, or 14.5% on a constant currency basis. Including projected future run-rate savings of $24.8 million from cost savings programs currently underway as permitted under our credit agreement and the indentures governing our outstanding notes, Adjusted EBITDA for the twelve months ended June 30, 2018 was $312.6 million.

Net cash provided by continuing operating activities was $9.0 million for the six months ended June 30, 2018 compared to $38.1 million for the six months ended July 1, 2017. The change in cash flow was primarily attributable to higher inventory balances to allow for the modernization and consolidation of distribution facilities as part of the Company’s transformation initiatives, and to the payment in 2018 of certain non-recurring costs accrued in 2017.

The Company defines Adjusted EBITDA as net (loss) income attributable to DJOFL plus net interest expense, income tax provision (benefit), and depreciation and amortization, further adjusted for certain non-cash items, non-recurring items and other adjustment items as permitted in calculating covenant compliance under the Company’s secured term loan and revolving credit facilities (“Senior Secured Credit Facilities”) and the indentures governing its 8.125% second lien notes and its 10.75% third lien notes. A reconciliation between net loss attributable to DJOFL and Adjusted EBITDA is included in the attached financial tables.

Conference Call Information

DJO has scheduled a conference call to discuss this announcement beginning at 4:30 pm, Eastern Time Monday, August 6, 2018. Individuals interested in listening to the conference call may do so by dialing (866) 394-8509 (International callers please use (346) 265-0698), using the reservation code 22322226. A telephone replay will be available for 48 hours following the conclusion of the call by dialing (855) 859-2056 and using the above reservation code. The live conference call and replay will be available via the Internet at www.DJOglobal.com.

About DJO Global

DJO Global is a leading global provider of medical technologies designed to get and keep people moving. The Company’s products address the continuum of patient care from injury prevention to rehabilitation, enabling people to regain or maintain their natural motion. Its products are used by orthopaedic surgeons, primary care physicians, pain management specialists, physical therapists, podiatrists, chiropractors, athletic trainers and other healthcare professionals. In addition, many of the Company’s medical devices and related accessories are used by athletes and patients for injury prevention and at-home physical therapy treatment. The Company’s product lines include rigid and soft orthopaedic bracing, hot and cold therapy, bone growth stimulators, vascular therapy systems and compression garments, therapeutic shoes and inserts, electrical stimulators used for pain management and physical therapy products. The Company’s surgical division offers a comprehensive suite of reconstructive joint products for the hip, knee and shoulder. DJO Global’s products are marketed under a portfolio of brands including Aircast®, Chattanooga, CMF™, Compex®, DonJoy®, ProCare®, DJO® Surgical, Dr. Comfort® and ExosTM. For additional information on the Company, please visit www.DJOglobal.com.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements relate to, among other things, the Company’s expectations for improved liquidity, estimated cost reductions associated with the execution of its business transformation plans and improved efficiencies. The words “believe,” “will,” “should,” “expect,” “target,” “intend,” “estimate” and “anticipate,” variations of such words and similar expressions identify forward-looking statements, but their absence does not mean that a statement is not a forward-looking statement. These forward-looking statements are based on the Company’s current expectations and are subject to a number of risks, uncertainties and assumptions, many of which are beyond the Company’s ability to control or predict. The Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The important factors that could cause actual operating results to differ significantly from those expressed or implied by such forward-looking statements include, but are not limited to the successful execution of the Company’s business transformation plans, including achievement of planned actions to improve liquidity, improvements in operational effectiveness, optimization of the Company’s procurement activities, improvements in manufacturing, distribution, sales and operations planning, and actions to improve the profitability of the mix of our product and customers. Other important factors that could cause actual operating results to differ significantly from those expressed or implied by such forward-looking statements include, but are not limited to: business strategies relative to our Bracing and Vascular, Recovery Sciences, International and Surgical Implant segments; the continued growth of the markets the Company addresses and any impact on these markets from changes in global economic conditions; the impact of potential reductions in reimbursement levels and coverage by Medicare and other governmental and commercial payers; the Company’s highly leveraged financial position; the Company’s ability to successfully develop, license or acquire, and timely introduce and market new products or product enhancements; risks relating to the Company’s international operations; resources needed and risks involved in complying with government regulations and government investigations; the availability and sufficiency of insurance coverage for pending and future product liability claims; and the effects of healthcare reform, Medicare competitive bidding, managed care and buying groups on the prices of the Company’s products. These and other risk factors related to DJO are detailed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017, filed with the Securities and Exchange Commission on March 16, 2018. Many of the factors that will determine the outcome of the subject matter of this press release are beyond the Company’s ability to control or predict.

|

|

|

|

|

|

|

| DJO FINANCE LLC |

| UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (in thousands) |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

June 30,

2018

|

|

|

July 1,

2017

|

|

|

June 30,

2018

|

|

|

July 1,

2017

|

|

| Net sales |

|

$ |

304,837 |

|

|

$ |

294,746 |

|

|

$ |

597,466 |

|

|

$ |

583,135 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales (exclusive of amortization of intangible assets of $6,635 and $13,293 for the three and six months ended June 30, 2018, respectively and $6,980 and $13,961 for the three and six months ended July 1, 2017, respectively) |

|

|

126,443 |

|

|

|

124,885 |

|

|

|

246,379 |

|

|

|

244,454 |

|

| Selling, general and administrative |

|

|

117,626 |

|

|

|

135,739 |

|

|

|

232,942 |

|

|

|

269,901 |

|

| Research and development |

|

|

9,707 |

|

|

|

9,063 |

|

|

|

18,988 |

|

|

|

18,202 |

|

| Amortization of intangible assets |

|

|

15,289 |

|

|

|

16,016 |

|

|

|

29,888 |

|

|

|

34,861 |

|

|

|

|

269,065 |

|

|

|

285,703 |

|

|

|

528,197 |

|

|

|

567,418 |

|

| Operating income |

|

|

35,772 |

|

|

|

9,043 |

|

|

|

69,269 |

|

|

|

15,717 |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

(45,779 |

) |

|

|

(43,068 |

) |

|

|

(89,701 |

) |

|

|

(85,755 |

) |

| Other (expense) income, net |

|

|

1,054 |

|

|

|

896 |

|

|

|

(487 |

) |

|

|

1,184 |

|

|

|

|

(44,725 |

) |

|

|

(42,172 |

) |

|

|

(90,188 |

) |

|

|

(84,571 |

) |

| Loss before income taxes |

|

|

(8,953 |

) |

|

|

(33,129 |

) |

|

|

(20,919 |

) |

|

|

(68,854 |

) |

| Income tax provision |

|

|

4,635 |

|

|

|

1,095 |

|

|

|

10,019 |

|

|

|

5,173 |

|

| Net loss from continuing operations |

|

|

(13,588 |

) |

|

|

(34,224 |

) |

|

|

(30,938 |

) |

|

|

(74,027 |

) |

| Net income from discontinued operations |

|

|

178 |

|

|

|

47 |

|

|

|

321 |

|

|

|

105 |

|

| Net loss |

|

|

(13,410 |

) |

|

|

(34,177 |

) |

|

|

(30,617 |

) |

|

|

(73,922 |

) |

| Net income attributable to noncontrolling interests |

|

|

(276 |

) |

|

|

(206 |

) |

|

|

(638 |

) |

|

|

(430 |

) |

| Net loss attributable to DJO Finance LLC |

|

$ |

(13,686 |

) |

|

$ |

(34,383 |

) |

|

$ |

(31,255 |

) |

|

$ |

(74,352 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DJO FINANCE LLC

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2018

|

|

|

|

|

|

December 31,

2017

|

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

|

$ |

26,789 |

|

|

|

|

|

$ |

31,985 |

|

| Accounts receivable, net |

|

|

|

|

179,611 |

|

|

|

|

|

|

190,324 |

|

| Inventories, net |

|

|

|

|

177,273 |

|

|

|

|

|

|

169,137 |

|

| Prepaid expenses and other current assets |

|

|

|

|

32,144 |

|

|

|

|

|

|

20,218 |

|

| Current assets of discontinued operations |

|

|

|

|

511 |

|

|

|

|

|

|

511 |

|

| Total current assets |

|

|

|

|

416,328 |

|

|

|

|

|

|

412,175 |

|

| Property and equipment, net |

|

|

|

|

137,496 |

|

|

|

|

|

|

133,522 |

|

| Goodwill |

|

|

|

|

878,963 |

|

|

|

|

|

|

864,112 |

|

| Intangible assets, net |

|

|

|

|

585,268 |

|

|

|

|

|

|

607,088 |

|

| Other assets |

|

|

|

|

5,242 |

|

|

|

|

|

|

5,128 |

|

| Total assets |

|

|

|

$ |

2,023,297 |

|

|

|

|

|

$ |

2,022,025 |

|

| LIABILITIES AND DEFICIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

|

$ |

105,144 |

|

|

|

|

|

$ |

98,331 |

|

| Accrued interest |

|

|

|

|

18,615 |

|

|

|

|

|

|

18,015 |

|

| Current portion of debt obligations |

|

|

|

|

26,022 |

|

|

|

|

|

|

15,936 |

|

| Other current liabilities |

|

|

|

|

116,071 |

|

|

|

|

|

|

126,360 |

|

| Total current liabilities |

|

|

|

|

265,852 |

|

|

|

|

|

|

258,642 |

|

| Long-term debt obligations |

|

|

|

|

2,414,519 |

|

|

|

|

|

|

2,398,184 |

|

| Deferred tax liabilities, net |

|

|

|

|

146,108 |

|

|

|

|

|

|

142,597 |

|

| Other long-term liabilities |

|

|

|

|

20,968 |

|

|

|

|

|

|

13,080 |

|

| Total liabilities |

|

|

|

$ |

2,847,447 |

|

|

|

|

|

$ |

2,812,503 |

|

| Commitments and contingencies (Note 14) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deficit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| DJO Finance LLC membership deficit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Member capital |

|

|

|

|

845,708 |

|

|

|

|

|

|

844,115 |

|

| Accumulated deficit |

|

|

|

|

(1,646,850 |

) |

|

|

|

|

|

(1,615,536 |

) |

| Accumulated other comprehensive loss |

|

|

|

|

(25,579 |

) |

|

|

|

|

|

(21,072 |

) |

| Total membership deficit |

|

|

|

|

(826,721 |

) |

|

|

|

|

|

(792,493 |

) |

| Noncontrolling interests |

|

|

|

|

2,571 |

|

|

|

|

|

|

2,015 |

|

| Total deficit |

|

|

|

|

(824,150 |

) |

|

|

|

|

|

(790,478 |

) |

| Total liabilities and deficit |

|

|

|

$ |

2,023,297 |

|

|

|

|

|

$ |

2,022,025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DJO FINANCE LLC

UNAUDITED SEGMENT INFORMATION

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

Six Months Ended |

|

|

|

|

|

June 30,

2018

|

|

|

|

|

July 1,

2017

|

|

|

|

|

June 30,

2018

|

|

|

|

|

July 1,

2017

|

|

| Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bracing and Vascular |

|

|

|

$ |

126,512 |

|

|

|

|

$ |

126,415 |

|

|

|

|

$ |

241,001 |

|

|

|

|

$ |

248,468 |

|

| Recovery Sciences |

|

|

|

|

37,454 |

|

|

|

|

|

38,774 |

|

|

|

|

|

73,347 |

|

|

|

|

|

77,277 |

|

| Surgical Implant |

|

|

|

|

53,918 |

|

|

|

|

|

49,991 |

|

|

|

|

|

107,537 |

|

|

|

|

|

99,583 |

|

| International |

|

|

|

|

86,953 |

|

|

|

|

|

79,566 |

|

|

|

|

|

175,581 |

|

|

|

|

|

157,807 |

|

|

|

|

|

$ |

304,837 |

|

|

|

|

$ |

294,746 |

|

|

|

|

$ |

597,466 |

|

|

|

|

$ |

583,135 |

|

| Operating income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bracing and Vascular |

|

|

|

$ |

29,257 |

|

|

|

|

$ |

24,225 |

|

|

|

|

$ |

49,255 |

|

|

|

|

$ |

45,232 |

|

| Recovery Sciences |

|

|

|

|

9,656 |

|

|

|

|

|

10,709 |

|

|

|

|

|

18,249 |

|

|

|

|

|

19,616 |

|

| Surgical Implant |

|

|

|

|

11,166 |

|

|

|

|

|

10,062 |

|

|

|

|

|

22,930 |

|

|

|

|

|

18,202 |

|

| International |

|

|

|

|

19,436 |

|

|

|

|

|

13,509 |

|

|

|

|

|

38,849 |

|

|

|

|

|

27,119 |

|

| Expenses not allocated to segments and eliminations |

|

|

|

|

(33,743 |

) |

|

|

|

|

(49,462 |

) |

|

|

|

|

(60,014 |

) |

|

|

|

|

(94,452 |

) |

|

|

|

|

$ |

35,772 |

|

|

|

|

$ |

9,043 |

|

|

|

|

$ |

69,269 |

|

|

|

|

$ |

15,717 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DJO Finance LLC

Adjusted EBITDA

For the Six Months Ended June 30, 2018 and July 1, 2017

(unaudited)

Our Senior Secured Credit Facilities, consisting of a $1,055.0 million term loan facility (including a $20.0 million delayed draw term loan facility) and a $150.0 million asset-based revolving credit facility, under which $87.5 million was outstanding as of June 30, 2018, and the Indentures governing our $1,015.0 million of 8.125% second lien notes and $298.5 million of 10.75% third lien notes (collectively, the “notes”) represent significant components of our capital structure. Under our Senior Secured Credit Facilities, we are required to maintain a specified senior secured first lien leverage ratio, which is determined based on our Adjusted EBITDA. If we fail to comply with the senior secured first lien leverage ratio under our Senior Secured Credit Facilities, we would be in default. Upon the occurrence of an event of default under the Senior Secured Credit Facilities, the lenders could elect to declare all amounts outstanding under the Senior Secured Credit Facilities to be immediately due and payable and terminate all commitments to extend further credit. If we were unable to repay those amounts, the lenders under the Senior Secured Credit Facilities could proceed against the collateral granted to them to secure that indebtedness. We have pledged substantially all of our assets as collateral under the Senior Secured Credit Facilities and under the notes. Any acceleration under the Senior Secured Credit Facilities would also result in a default under the Indentures governing the notes, which could lead to the note holders electing to declare the principal, premium, if any, and interest on the then outstanding notes immediately due and payable. In addition, under the Indentures governing the notes, our and our subsidiaries’ ability to engage in activities such as incurring additional indebtedness, making investments, refinancing subordinated indebtedness, paying dividends and entering into certain merger transactions is governed, in part, by our ability to satisfy tests based on Adjusted EBITDA. Our ability to meet the covenants specified in the Senior Secured Credit Facilities and the Indentures governing those notes will depend on future events, some of which are beyond our control, and we cannot assure you that we will meet those covenants.

Adjusted EBITDA is defined as net income (loss) attributable to DJOFL plus interest expense, net, income tax provision (benefit), and depreciation and amortization, further adjusted for certain non-cash items, non-recurring items and other adjustment items as permitted in calculating covenant compliance and other ratios under our Senior Secured Credit Facilities and the Indentures governing the notes. We believe that the presentation of Adjusted EBITDA is appropriate to provide additional information to investors about the calculation of, and compliance with, certain financial covenants and other ratios in our Senior Secured Credit Facilities and the Indentures governing the notes. Adjusted EBITDA is a material component of these calculations.

Adjusted EBITDA should not be considered as an alternative to net income (loss) attributable to DJOFL or other performance measures presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”), or as an alternative to cash flow from operations as a measure of our liquidity. Adjusted EBITDA does not represent net income (loss) attributable to DJOFL or cash flow from operations as those terms are defined by GAAP and does not necessarily indicate whether cash flows will be sufficient to fund cash needs. In particular, the definition of Adjusted EBITDA under our Senior Secured Credit Facilities and the Indentures governing the notes allows us to add back certain non-cash, extraordinary, unusual or non-recurring charges that are deducted in calculating net income (loss) attributable to DJOFL. However, these are expenses that may recur, vary greatly and are difficult to predict. While Adjusted EBITDA and similar measures are frequently used as measures of operations and the ability to meet debt service requirements, Adjusted EBITDA is not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation.

The following table provides reconciliation between net income (loss) attributable to DJOFL and Adjusted EBITDA (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Months |

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Six Months Ended |

|

|

|

|

|

Ended |

|

|

|

|

|

June 30, |

|

|

|

|

|

July 1, |

|

|

|

|

|

June 30, |

|

|

|

|

|

July 1, |

|

|

|

|

|

June 30, |

|

|

|

|

|

2018 |

|

|

|

|

|

2017 |

|

|

|

|

|

2018 |

|

|

|

|

|

2017 |

|

|

|

|

|

2018 |

|

| Net loss attributable to DJO Finance LLC |

|

|

|

$ |

(13,686 |

) |

|

|

|

|

$ |

(34,383 |

) |

|

|

|

|

$ |

(31,255 |

) |

|

|

|

|

$ |

(74,352 |

) |

|

|

|

|

$ |

7,203 |

|

| Income loss from discontinued operations, net |

|

|

|

|

(178 |

) |

|

|

|

|

|

(47 |

) |

|

|

|

|

|

(321 |

) |

|

|

|

|

|

(105 |

) |

|

|

|

|

|

(525 |

) |

| Interest expense, net |

|

|

|

|

45,779 |

|

|

|

|

|

|

43,068 |

|

|

|

|

|

|

89,701 |

|

|

|

|

|

|

85,755 |

|

|

|

|

|

|

178,184 |

|

| Income tax provision (benefit) |

|

|

|

|

4,635 |

|

|

|

|

|

|

1,095 |

|

|

|

|

|

|

10,019 |

|

|

|

|

|

|

5,173 |

|

|

|

|

|

|

(55,873 |

) |

| Depreciation and amortization |

|

|

|

|

27,871 |

|

|

|

|

|

|

26,942 |

|

|

|

|

|

|

53,376 |

|

|

|

|

|

|

56,716 |

|

|

|

|

|

|

107,921 |

|

| Non-cash charges (a) |

|

|

|

|

524 |

|

|

|

|

|

|

537 |

|

|

|

|

|

|

749 |

|

|

|

|

|

|

1,108 |

|

|

|

|

|

|

4,742 |

|

| Non-recurring and integration charges (b) |

|

|

|

|

10,737 |

|

|

|

|

|

|

25,195 |

|

|

|

|

|

|

16,257 |

|

|

|

|

|

|

43,584 |

|

|

|

|

|

|

41,922 |

|

| Other adjustment items (c) |

|

|

|

|

(68 |

) |

|

|

|

|

|

1,142 |

|

|

|

|

|

|

1,888 |

|

|

|

|

|

|

2,911 |

|

|

|

|

|

|

4,242 |

|

|

|

|

|

|

75,614 |

|

|

|

|

|

|

63,549 |

|

|

|

|

|

|

140,414 |

|

|

|

|

|

|

120,790 |

|

|

|

|

|

|

287,816 |

|

| Permitted pro forma adjustments applicable to the twelve-month period only – Note 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Future cost savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24,810 |

|

| Adjusted EBITDA |

|

|

|

$ |

75,614 |

|

|

|

|

|

$ |

63,549 |

|

|

|

|

|

$ |

140,414 |

|

|

|

|

|

$ |

120,790 |

|

|

|

|

|

$ |

312,626 |

|

________________________________________

Note 1 — Permitted pro forma adjustments include future cost savings from cost reduction actions related to our business transformation initiative, recognized as permitted under our credit agreement and the indentures governing our notes.

(a) Non-cash charges are comprised of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Months |

|

|

|

|

Three Months Ended |

|

|

|

|

Six Months Ended |

|

|

|

|

Ended |

|

|

|

|

June 30, |

|

|

|

|

July 1, |

|

|

|

|

June 30, |

|

|

|

|

July 1, |

|

|

|

|

June 30, |

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

|

|

2018 |

| Stock compensation expense |

|

|

|

$ |

447 |

|

|

|

|

$ |

392 |

|

|

|

|

$ |

895 |

|

|

|

|

$ |

846 |

|

|

|

|

$ |

3,745 |

| (Gain) loss on disposal of fixed assets and assets held for sale, net |

|

|

|

|

77 |

|

|

|

|

|

145 |

|

|

|

|

|

(146 |

) |

|

|

|

|

262 |

|

|

|

|

|

997 |

| Total non-cash charges |

|

|

|

$ |

524 |

|

|

|

|

$ |

537 |

|

|

|

|

$ |

749 |

|

|

|

|

$ |

1,108 |

|

|

|

|

$ |

4,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(b) Non-recurring and integration charges are comprised of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Months |

|

|

|

|

Three Months Ended |

|

|

|

|

Six Months Ended |

|

|

|

|

Ended |

|

|

|

|

June 30, |

|

|

|

|

July 1, |

|

|

|

|

June 30, |

|

|

|

|

July 1, |

|

|

|

|

June 30, |

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

|

|

2018 |

| Restructuring and reorganization (1) |

|

|

|

$ |

7,823 |

|

|

|

|

$ |

23,273 |

|

|

|

|

$ |

11,492 |

|

|

|

|

$ |

39,069 |

|

|

|

|

$ |

32,665 |

| Acquisition related expenses and integration (2) |

|

|

|

|

379 |

|

|

|

|

|

277 |

|

|

|

|

|

749 |

|

|

|

|

|

579 |

|

|

|

|

|

2,276 |

| Executive transition |

|

|

|

|

– |

|

|

|

|

|

(49 |

) |

|

|

|

|

– |

|

|

|

|

|

(49 |

) |

|

|

|

|

– |

| Litigation and regulatory costs and settlements, net |

|

|

|

|

2,535 |

|

|

|

|

|

1,290 |

|

|

|

|

|

4,016 |

|

|

|

|

|

3,392 |

|

|

|

|

|

6,881 |

| IT automation projects |

|

|

|

|

– |

|

|

|

|

|

404 |

|

|

|

|

|

– |

|

|

|

|

|

593 |

|

|

|

|

|

100 |

| Total non-recurring and integration charges |

|

|

|

$ |

10,737 |

|

|

|

|

$ |

25,195 |

|

|

|

|

$ |

16,257 |

|

|

|

|

$ |

43,584 |

|

|

|

|

$ |

41,922 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Consist of costs related to the Company’s business transformation projects to improve the Company’s operational profitability and liquidity.

(2) Consists of direct acquisition costs and integration expenses related to acquired businesses and costs related to potential acquisitions.

(c) Other adjustment items before permitted pro forma adjustments are comprised of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Months |

|

|

|

|

|

Three Months Ended |

|

|

|

|

Six Months Ended |

|

|

|

|

Ended |

|

|

|

|

|

June 30, |

|

|

|

|

July 1, |

|

|

|

|

June 30, |

|

|

|

|

July 1, |

|

|

|

|

June 30, |

|

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

|

|

2018 |

|

|

|

|

2017 |

|

|

|

|

2018 |

|

| Blackstone monitoring fees |

|

|

|

$ |

– |

|

|

|

|

$ |

1,750 |

|

|

|

|

$ |

– |

|

|

|

|

$ |

3,500 |

|

|

|

|

$ |

2,725 |

|

| Non-controlling interests |

|

|

|

|

276 |

|

|

|

|

|

206 |

|

|

|

|

|

638 |

|

|

|

|

|

430 |

|

|

|

|

|

1,007 |

|

| Foreign currency transaction losses (gains) and other expense (income) |

|

|

|

|

(1,054 |

) |

|

|

|

|

– |

|

|

|

|

|

487 |

|

|

|

|

|

– |

|

|

|

|

|

(444 |

) |

| Franchise and other tax |

|

|

|

|

710 |

|

|

|

|

|

– |

|

|

|

|

|

763 |

|

|

|

|

|

– |

|

|

|

|

|

954 |

|

| Other (1) |

|

|

|

|

– |

|

|

|

|

|

(814 |

) |

|

|

|

|

– |

|

|

|

|

|

(1,019 |

) |

|

|

|

|

– |

|

| Total other adjustment items |

|

|

|

$ |

(68 |

) |

|

|

|

$ |

1,142 |

|

|

|

|

$ |

1,888 |

|

|

|

|

$ |

2,911 |

|

|

|

|

$ |

4,242 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Other adjustments consist primarily of net realized and unrealized foreign currency translation gains and losses.