BELGRADE, MT, Aug. 07, 2018 (GLOBE NEWSWIRE) — Xtant Medical Holdings, Inc. (NYSE American:XTNT), a leader in the development of regenerative medicine products and medical devices, today reported financial and operating results for the second quarter ended June 30, 2018.

Summary of Second Quarter 2018 Financial Highlights and Recent Announcements:

- Revenue for the second quarter of 2018 was $18.7 million, down from $21.4 million for the second quarter of 2017

- Gross Margin for the second quarter of 2018 was 66.6%, compared to 63.2% for the same period in the prior year

- Net loss incurred in the second quarter 2018 was $5.0 million compared to a loss of $9.7 million in the same period of the prior year

- Non-GAAP Adjusted EBITDA was $0.8 million, compared to a loss of approximately $2.1 million during the second quarter of 2017

- The Company expanded its executive management team with the appointment of Kevin Brandt as Chief Commercial Officer

- Xtant Medical stockholders approved the 2018 Equity Incentive Plan

“In reflecting on our performance through the first half of the year, I am very excited about our future as a Company,” said Carl O’Connell, Xtant Medical’s chief executive officer. “We have made very positive strides and changes so far in 2018, including the restructuring of our balance sheet with the recent debt conversion, improved gross margins, efficiencies in consolidation of operations to Belgrade, MT and now importantly, expansion of our leadership team with the recent addition of Kevin Brandt as chief commercial officer.”

Second Quarter 2018 Financial Results

Revenue for the second quarter of 2018 was $18.7 million, down from $21.4 million compared to the same period of the prior year. The decrease occurred in the Company’s fixation product lines due principally to competitive factors and a strategic focus on reducing unprofitable sales channel arrangements while improving gross margin and adjusted EBITDA. This strategic decision, which was implemented in the beginning of the third quarter last year, has contributed positively to many other areas of the business.

Gross margin for the second quarter of 2018 was 66.6%, up from 63.2% for the same period in 2017. This improvement was due to the Company’s focus on profitable sales channel relationships with higher margins, and from the benefits of restructuring some several operational areas of the organization for efficiencies and cost reduction.

Operating expenses for the second quarter of 2018 were $14.7 million, 78.6% of net revenue, down $5.2 million compared to $19.9 million in the quarter ended June 30, 2017, which was 92.9% of net revenue. The improvement occurred as the Company positions itself for future long-term growth through execution of its channel strategy, moving on from select high-commission sales arrangements, cost reduction and efficiency programs to streamline its operations, including consolidation of facilities, and lower restructuring expenses.

The net loss from operations for the second quarter of 2018 was $5.0 million compared to a loss of $9.7 million for the same period in the prior year, with a net loss per share of $0.38 compared to a net loss of $6.43 per share for the same quarter in the prior year.

Non-GAAP Adjusted EBITDA for the second quarter of 2018 was approximately $0.8 million compared to a loss of $2.1 million for the same period during 2017. The Company defines Adjusted EBITDA as net income/loss from operations before depreciation, amortization and interest expense, and as further adjusted to add back in or exclude non-cash stock-based compensation, change in warrant derivative liability, separation related expenses, Dayton transition costs and restructuring expenses. A calculation and reconciliation of net loss to non-GAAP Adjusted EBITDA can be found in the attached financial tables.

Appointment of Kevin Brandt to Executive Management Team

Kevin Brandt recently joined Xtant as the chief commercial officer. He is responsible for executing the Company’s sales and marketing initiatives, and driving the commercial strategy of the organization. Mr. Brandt brings over 28 years of orthopedic experience in the commercial space, most recently as the chief commercial officer of RTI Surgical, where he led all domestic direct lines of business. Prior to joining RTI Surgical he spent 18 years at Stryker Corporation in various senior commercial leadership positions.

Stockholders Approved the 2018 Equity Incentive Plan

The Xtant Medical stockholders approved the Xtant Medical Holdings, Inc. 2018 Equity Incentive Plan (the “2018 Plan”). The approval occurred at the 2018 annual meeting of stockholders on August 1, 2018, upon recommendation from the Board of Directors.

The 2018 Plan permits the Board, or a committee thereof, to grant to eligible employees, non-employee directors and consultants of the Company non-statutory and incentive stock options, restricted stock, restricted stock units and other stock-based awards. The Board may select 2018 Plan participants and determine the nature and amounts of awards to be granted. Subject to adjustment as provided in the 2018 Plan, the number of shares of Company common stock available for issuance under the 2018 Plan is 1,307,747 shares.

The 2018 Plan replaces the Amended and Restated Xtant Medical Equity Incentive Plan and will expire on July 31, 2028.

Convertible Debt Restructuring

In the first quarter ended March 31, 2018, the Company entered into a restructuring and exchange agreement with holders of Xtant’s then outstanding 6% convertible senior unsecured notes due 2021. Pursuant to that agreement, all outstanding convertible notes, constituting $71.9 million in outstanding principal amount, plus accrued and unpaid interest, were converted into 10.6 million shares of Xtant common stock. Most of the conversions occurred on February 14, 2018, after the receipt of stockholder approval of aspects of the restructuring transaction and the effectiveness of a 1-for-12 reverse stock split, which occurred at the close of business on February 13, 2018. On February 14, 2018, the Company issued 945,819 shares of common stock in a private placement at a price per share of $7.20 for cash proceeds of $6.8 million.

Conference Call

The Company will host a conference call to discuss the second quarter 2018 financial results and business developments on Wednesday, August 8, 2018 at 9:00 AM EDT. Please refer to the information below for conference call dial-in information and webcast registration:

Conference date: August 8, 2018, 9:00 AM ET

Conference dial-in: 877-407-6184

International dial-in: 201-389-0877

Conference Call Name: Xtant Medical’s Second Quarter 2018 Results Call

Webcast Registration: Click Here

Following the live call, a replay will be available on the Company’s website, www.xtantmedical.com, under “Investor Info.”

About Xtant Medical

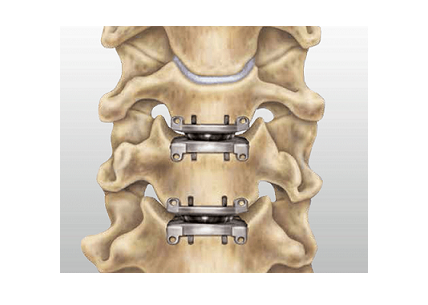

Xtant Medical develops, manufactures and markets regenerative medicine products and medical devices for domestic and international markets. Xtant Medical products serve the specialized needs of orthopedic and neurological surgeons, including orthobiologics for the promotion of bone healing, implants and instrumentation for the treatment of spinal disease, tissue grafts for the treatment of orthopedic disorders, and biologics to promote healing following cranial, and foot and ankle surgeries. With core competencies in both biologic and non-biologic surgical technologies, Xtant Medical can leverage its resources to successfully compete in global neurological and orthopedic surgery markets. For further information, please visit www.xtantmedical.com.

Non-GAAP Financial Measures

To supplement the Company’s consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP), the Company uses certain non-GAAP financial measures in this release, including Adjusted EBITDA. Reconciliations of the non-GAAP financial measures used in this release to the most comparable GAAP measures for the respective periods can be found in tables later in this release. The Company’s management believes that the presentation of these measures provides useful information to investors. These measures may assist investors in evaluating the company’s operations, period over period. Management uses the non-GAAP measures in this release internally for evaluation of the performance of the business, including the allocation of resources. Investors should consider non-GAAP financial measures only as a supplement to, not as a substitute for or as superior to, measures of financial performance prepared in accordance with GAAP.

Important Cautions Regarding Forward-looking Statements

This press release contains certain disclosures that may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as ‘‘continue,” ‘‘expects,” ‘‘anticipates,” ‘‘intends,” ‘‘plans,” ‘‘believes,” ‘‘estimates,” ‘‘strategy,” “future,” ‘‘will,” “can” or similar expressions or the negative thereof. Statements of historical fact also may be deemed to be forward-looking statements. The Company cautions that these statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others: the ability to increase revenue; the ability to achieve expected results; the ability to remain competitive; the ability to innovate and develop new products; the ability to engage and retain qualified personnel; government and third-party coverage and reimbursement for Company products; the ability to obtain and maintain regulatory approvals; government regulations; product liability claims and other litigation to which we may be subject; product recalls and defects; timing and results of clinical studies; the ability to obtain and protect Company intellectual property and proprietary rights and operate without infringing the rights of others; the ability to service Company debt and comply with debt covenants; the ability to raise additional financing and other factors. Additional risk factors are listed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 filed with the Securities and Exchange Commission (SEC) on April 2, 2018 and subsequent SEC filings by the Company, including without limitation its Quarterly Reports on Form 10-Q for the quarters ended March 31, 2018 and June 30, 2018. Investors are encouraged to read the Company’s filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The Company undertakes no obligation to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except as required by law. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

XTANT MEDICAL HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except number of shares and par value)

| As of | As of | ||||||||

| June 30, | December 31, | ||||||||

| 2018 | 2017 | ||||||||

| (Unaudited) | |||||||||

| ASSETS | |||||||||

| Current Assets: | |||||||||

| Cash and cash equivalents | $ | 6,049 | $ | 2,856 | |||||

| Trade accounts receivable, net of allowance for doubtful accounts of $2,118 and $1,923, respectively | 10,404 | 12,714 | |||||||

| Current inventories, net | 22,446 | 22,229 | |||||||

| Prepaid and other current assets | 801 | 1,706 | |||||||

| Total current assets | 39,700 | 39,505 | |||||||

| Non-current inventories, net | – | 194 | |||||||

| Property and equipment, net | 8,928 | 9,913 | |||||||

| Goodwill | 41,535 | 41,535 | |||||||

| Intangible assets, net | 12,106 | 13,826 | |||||||

| Other assets | 516 | 732 | |||||||

| Total Assets | $ | 102,785 | $ | 105,705 | |||||

| LIABILITIES & STOCKHOLDERS’ EQUITY (DEFICIT) | |||||||||

| Current Liabilities: | |||||||||

| Accounts payable | $ | 7,526 | $ | 9,316 | |||||

| Accounts payable – related party | – | 160 | |||||||

| Accrued liabilities | 4,310 | 15,845 | |||||||

| Warrant derivative liability | 90 | 131 | |||||||

| Current portion of capital lease obligations | 469 | 366 | |||||||

| Total current liabilities | 12,395 | 25,818 | |||||||

| Long-term Liabilities: | |||||||||

| Capital lease obligation, less current portion | 353 | 623 | |||||||

| Long-term convertible debt, less issuance costs | – | 70,854 | |||||||

| Long-term debt, less issuance costs | 79,429 | 67,109 | |||||||

| Total Liabilities | 92,177 | 164,404 | |||||||

| Commitments and Contingencies | |||||||||

| Stockholders’ Equity (Deficit): | |||||||||

| Preferred stock, $0.000001 par value; 10,000,000 shares authorized; no shares issued and outstanding | – | – | |||||||

| Common stock, $0.000001 par value; 50,000,000 shares authorized; 13,145,305 shares issued and outstanding as of June 30, 2018 and 1,514,899 shares issued and outstanding as of December 31, 2017 | – | – | |||||||

| Additional paid-in capital | 165,809 | 86,247 | |||||||

| Accumulated deficit | (155,521 | ) | (144,946 | ) | |||||

| Total Stockholders’ Equity (Deficit) | 10,608 | (58,699 | ) | ||||||

| Total Liabilities & Stockholders’ Equity (Deficit) | $ | 102,785 | $ | 105,705 | |||||

XTANT MEDICAL HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in thousands, except number of shares and per share amounts)

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||

| (Restated) | ||||||||||||

| Revenue | ||||||||||||

| Orthopedic product sales | $ | 18,653 | $ | 21,371 | $ | 36,483 | $ | 43,367 | ||||

| Other revenue | 88 | 37 | 191 | 124 | ||||||||

| Total Revenue | 18,741 | 21,408 | 36,674 | 43,491 | ||||||||

| Cost of sales | 6,266 | 7,880 | 11,968 | 15,056 | ||||||||

| Gross Profit | 12,475 | 13,528 | 24,706 | 28,435 | ||||||||

| Operating Expenses | ||||||||||||

| General and administrative | 3,402 | 4,527 | 6,425 | 8,655 | ||||||||

| Sales and marketing | 8,545 | 11,137 | 16,894 | 22,134 | ||||||||

| Research and development | 418 | 640 | 832 | 1,339 | ||||||||

| Depreciation and amortization | 1,041 | 1,470 | 2,045 | 2,751 | ||||||||

| Restructuring expenses | 1,234 | 1,632 | 1,968 | 1,632 | ||||||||

| Separation related expenses | 55 | 381 | 55 | 605 | ||||||||

| Non-cash compensation expense | 41 | 92 | 405 | 237 | ||||||||

| Total Operating Expenses | 14,736 | 19,879 | 28,624 | 37,353 | ||||||||

| Loss from Operations | (2,261 | ) | (6,351 | ) | (3,918 | ) | (8,918 | ) | ||||

| Other (Expense) Income | ||||||||||||

| Interest expenses | (2,820 | ) | (3,328 | ) | (6,366 | ) | (6,729 | ) | ||||

| Change in warrant derivative liability | 79 | (14 | ) | 41 | 156 | |||||||

| Other (expense) income | – | – | (12 | ) | 11 | |||||||

| Total Other (Expense) Income | (2,741 | ) | (3,342 | ) | (6,337 | ) | (6,562 | ) | ||||

| Net Loss From Operations | $ | (5,002 | ) | $ | (9,693 | ) | $ | (10,255 | ) | $ | (15,480 | ) |

| Net loss per share: | ||||||||||||

| Basic | $ | (0.38 | ) | $ | (6.43 | ) | $ | (1.00 | ) | $ | (10.31 | ) |

| Dilutive | $ | (0.38 | ) | $ | (6.43 | ) | $ | (1.00 | ) | $ | (10.31 | ) |

| Shares used in the computation: | ||||||||||||

| Basic | 13,085,668 | 1,507,716 | 10,299,090 | 1,501,079 | ||||||||

| Dilutive | 13,085,668 | 1,507,716 | 10,299,090 | 1,501,079 | ||||||||

XTANT MEDICAL HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

| Six Months Ended June 30, | ||||||

| 2018 | 2017 | |||||

| (Restated) | ||||||

| Operating activities: | ||||||

| Net loss | $ | (10,255 | ) | $ | (15,477 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||

| Depreciation and amortization | 3,228 | 4,171 | ||||

| Non-cash interest | 6,205 | 6,211 | ||||

| Loss on disposal of fixed assets | 205 | 1,586 | ||||

| Non-cash compensation expense/stock option expense | 405 | 397 | ||||

| Provision for losses on accounts receivable and inventory | 83 | 1,063 | ||||

| Change in derivative warrant liability | (41 | ) | (156 | ) | ||

| Changes in operating assets and liabilities: | ||||||

| Accounts receivable | 2,152 | 2,544 | ||||

| Inventories | (388 | ) | 1,202 | |||

| Prepaid and other assets | 1,120 | 12 | ||||

| Accounts payable | (1,949 | ) | (2,372 | ) | ||

| Accrued liabilities | (421 | ) | 63 | |||

| Net cash provided by (used in) operating activities | 344 | (756 | ) | |||

| Investing activities: | ||||||

| Purchases of property and equipment and intangible assets | (288 | ) | (1,068 | ) | ||

| Net cash used in investing activities | (288 | ) | (1,068 | ) | ||

| Financing activities: | ||||||

| Proceeds from long-term debt | – | 11,387 | ||||

| Payments on capital leases | (167 | ) | (28 | ) | ||

| Payments on revolving line credit | – | (10,448 | ) | |||

| Expenses associated with private placement and convertible debt conversion | (3,507 | ) | – | |||

| Proceeds from equity private placement | 6,810 | – | ||||

| Proceeds from issuance of stock | 1 | – | ||||

| Net cash provided by financing activities | 3,137 | 911 | ||||

| Net change in cash and cash equivalents | 3,193 | (914 | ) | |||

| Cash and cash equivalents at beginning of period | 2,856 | 2,578 | ||||

| Cash and cash equivalents at end of period | $ | 6,049 | $ | 1,665 | ||

| XTANT MEDICAL HOLDINGS, INC. | |||||||||||||

| CALCULATION OF CONSOLIDATED EBITDA AND ADJUSTED EBITDA FOR THE PERIODS ENDED JUNE 30, 2018 | |||||||||||||

| (Unaudited, in thousands) | |||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||

| Unaudited | 2018 | 2017 | 2018 | 2017 | |||||||||

| Net loss | $ | (5,002 | ) | $ | (9,693 | ) | $ | (10,255 | ) | $ | (15,480 | ) | |

| Other expense | – | 12 | – | ||||||||||

| Depreciation & amortization | 1,671 | 2,100 | 3,289 | 4,171 | |||||||||

| Interest expense | 2,820 | 3,328 | 6,365 | 6,729 | |||||||||

| EBITDA (loss) | (511 | ) | (4,265 | ) | (589 | ) | (4,580 | ) | |||||

| EBITDA/Total revenue | (2.7 | %) | (19.9 | %) | (1.6 | %) | (10.5 | %) | |||||

| ADJUSTED EBITDA CALCULATION | |||||||||||||

| Change in warrant derivative liability | (79 | ) | 14 | (41 | ) | (156 | ) | ||||||

| Separation related expenses | 55 | 381 | 55 | 605 | |||||||||

| Non-cash compensation | 41 | 92 | 405 | 237 | |||||||||

| Dayton transition costs | 120 | – | 233 | – | |||||||||

| Restructuring expenses | 1,187 | 1,632 | 1,921 | 1,633 | |||||||||

| ADJUSTED EBITDA gain (loss) | $ | 813 | $ | (2,146 | ) | 1,984 | $ | (2,261 | ) | ||||

| ADJUSTED EBITDA/Total revenue | 4.3 | % | (10.0 | %) | 5.4 | % | (5.2 | %) | |||||

SOURCE: Xtant Medical Holdings, Inc.

Company Contact Xtant MedicalMolly Masonmmason@xtantmedical.comXtant Medical Holdings, Inc.

Source: Xtant Medical Holdings, Inc.