Medtronic, Zimmer Biomet Enter 2-level Cervical Disc and Robotic Markets

September 1, 2016 – By Carolyn LaWell

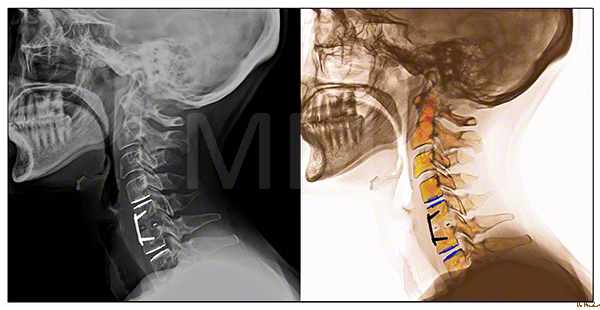

Disc Replacement

Zimmer Biomet’s $1 billion acquisition of LDR and its Mobi-C cervical disc assets and Medtronic’s FDA Premarket Approval for the Prestige LP 2-level application changed the game in the U.S. 2-level cervical disc replacement arena.

Mobi-C had been the only 2-level disc approved on the U.S. market. Prior to Zimmer Biomet’s purchase of the technology, LDR was able to expand reimbursement coverage, update label claims and publish peer-reviewed papers that resulted in Mobi-C’s sales growth, which increased 80% in 2015 vs. 2014.

Further, in April 2016, LDR reported that Mobi-C had surpassed $100 million in cumulative U.S. revenue since its 2013 launch. Half of the Mobi-C units sold address 1-level indications and half are for 2-level indications.

The acquisition of LDR allows Zimmer Biomet to increase its share of the worldwide spine market from 4% to 5%, according to ORTHOWORLD estimates. While the purchase also expands Zimmer Biomet’s traditional cervical and lumbar offerings, Mobi-C is presumably the technology that attracted Zimmer Biomet to LDR, primarily.

Medtronic’s entry into the 2-level market is expected to put competitive pressure on Zimmer Biomet’s purchase. The 2-level discs will be sold in a small market that faces a lack of reimbursement, compared to 1-level discs and fusion. To dive into specifics, >50 million lives are covered for Mobi-C’s 2-level procedure. The total artificial disc market is expected to reach ~$275 million in 2016, according to estimates in the ORTHOWORLD report, Cervical and Lumbar Artificial Disc Profiles.

OrthoSpineNews

OrthoSpineNews.com is the preferred aggregator of all news in the orthopedic and spine industry. You can subscribe for our daily email, follow us on twitter or download our app for iPhone and Android.